FFI Executive Summary

One of the most surprising aspects of the 2023 U.S. economy has been the resilience of the residential construction sector, despite the ongoing interest rate hikes. Building permits and housing starts initially declined as the rate hike cycle began but found support just above the 1.3 million level and have been gradually increasing since January. The recent data for May showed unexpectedly strong housing starts and permits, indicating that underlying demand for housing remains intact. This positive trend is reflected in the NAHB homebuilder sentiment survey, which has been trending higher for six consecutive months. However, it is important to note that these positive housing market dynamics cannot be directly extrapolated to other steel-consuming sectors. Each sector has its own unique dynamics that must be closely monitored, and anticipating a collapse in the broader economy based solely on the high fed funds rate would be a mistake.

Upside Risks:

- Reluctance to place import orders, leading to consistently subdued arrivals.

- Input costs continuing to elevate the floor for domestic producers

- China further introducing stimulus measures to bolster its construction sector

- Easing supply chain restraints and labor shortages causing an increase in activity

- Unplanned & extended planned outages causing production to fall below demand levels and cause a physical “short squeeze.”

Downside Risks:

- Rapid increases to domestic production capacity overshooting demand

- Steel consumers substitute to lower-cost alternatives

- Economic slowdown caused by increasing interest rates and sustained restrictive policy from the Federal Reserve

- Differentials rapidly increase and cause buyers to flood the domestic market with foreign material in 2H23

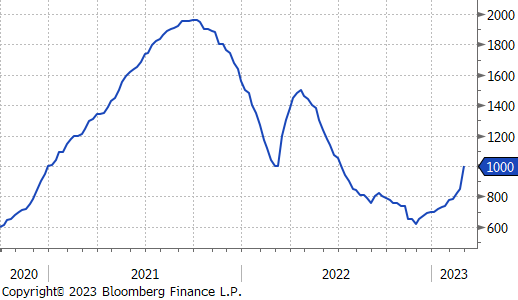

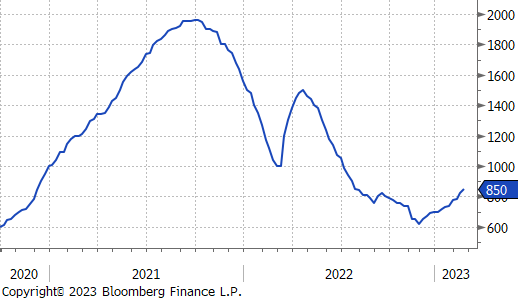

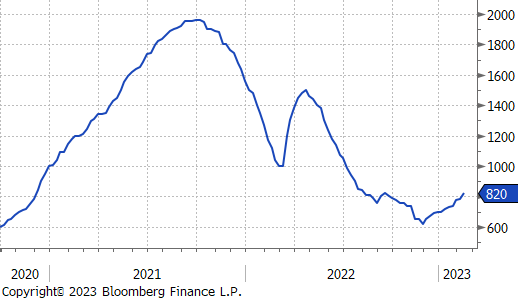

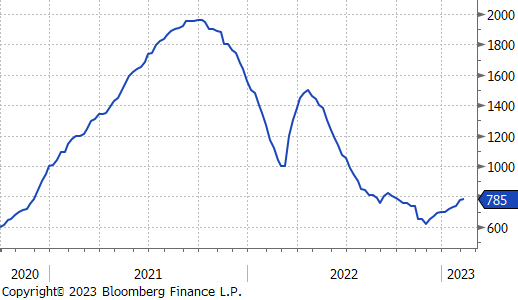

The HRC spot price was up for the first time in 11-weeks on the heels of a flurry of price increase announcements. The 2nd–month future (July) was up $5, or 0.6%, as well, but much of the remarked upon rally in the futures came from later expirations.

Steel Hedging | Steel Futures | Steel Price Risk Management

Steel Trading | Voluntary Carbon Credits

The Federal Reserve’s decision on a “hawkish pause” with interest rates was the most significant economic data last week. Interest rates were kept at a target range of 5-5.25%, marking the first time in 15 months that rates did not increase. The pause was intended to allow the impact of previous rate hikes to manifest, while updated projections indicated higher expectations for inflation and growth, and a lower projected unemployment rate. The divergence between headline and core CPI data in May showcased the concern around inflation, with headline CPI showing signs of deceleration but core CPI remaining elevated. As a result, rate cuts are not expected until core data aligns more closely with the target range of 2.5%.

Upside Risks:

- Reluctance to place import orders, leading to consistently subdued arrivals.

- Input costs continuing to elevate the floor for domestic producers

- China further introducing stimulus measures to bolster its construction sector

- Easing supply chain restraints and labor shortages causing an increase in activity

- Unplanned & extended planned outages causing production to fall below demand levels and cause a physical “short squeeze.”

Downside Risks:

- Rapid increases to domestic production capacity overshooting demand

- Steel consumers substitute to lower-cost alternatives

- Economic slowdown caused by increasing interest rates and sustained restrictive policy from the Federal Reserve

- Differentials rapidly increase and cause buyers to flood the domestic market with foreign material in 2H23

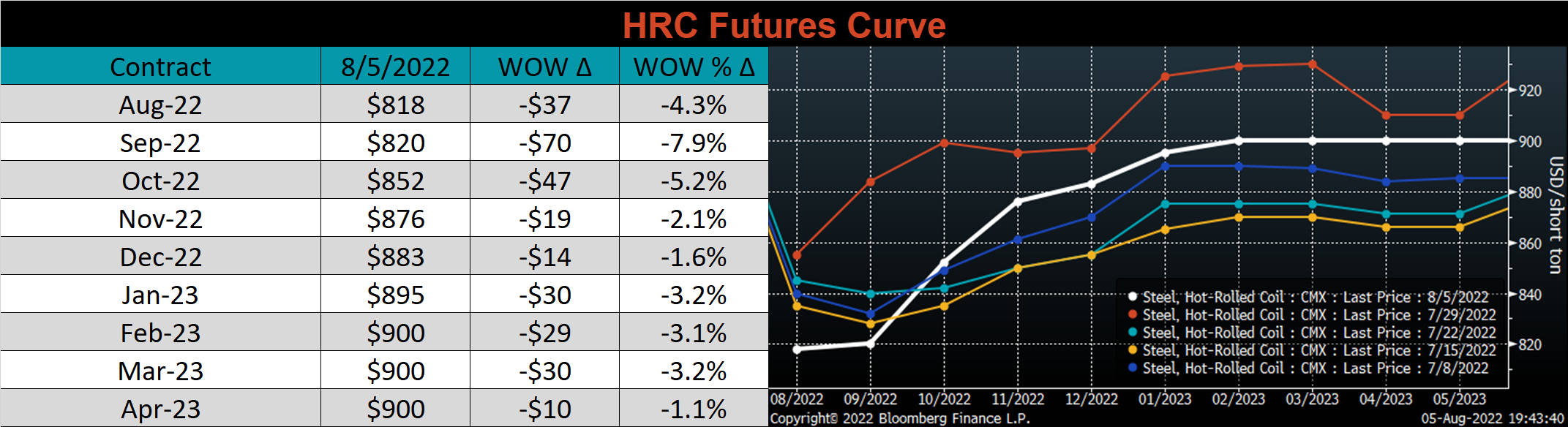

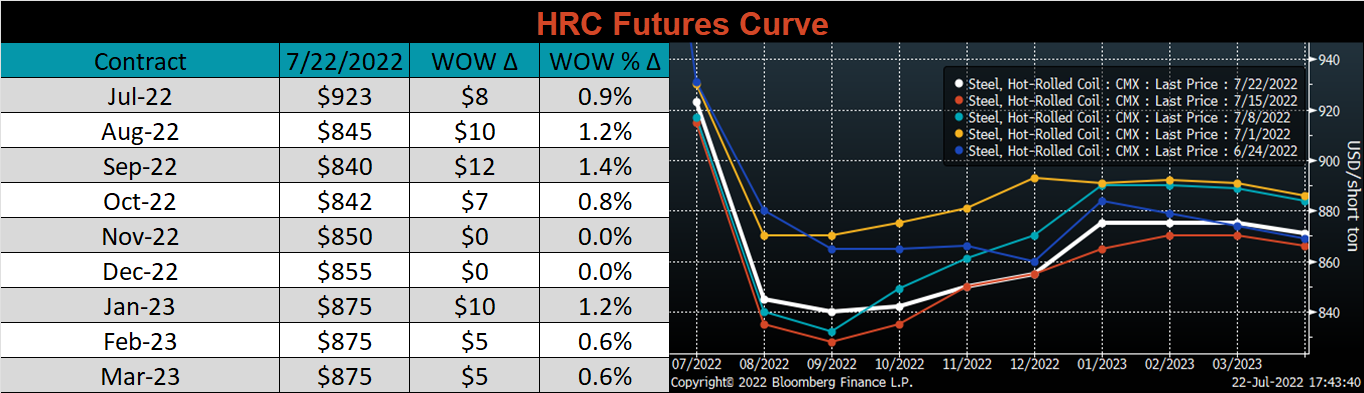

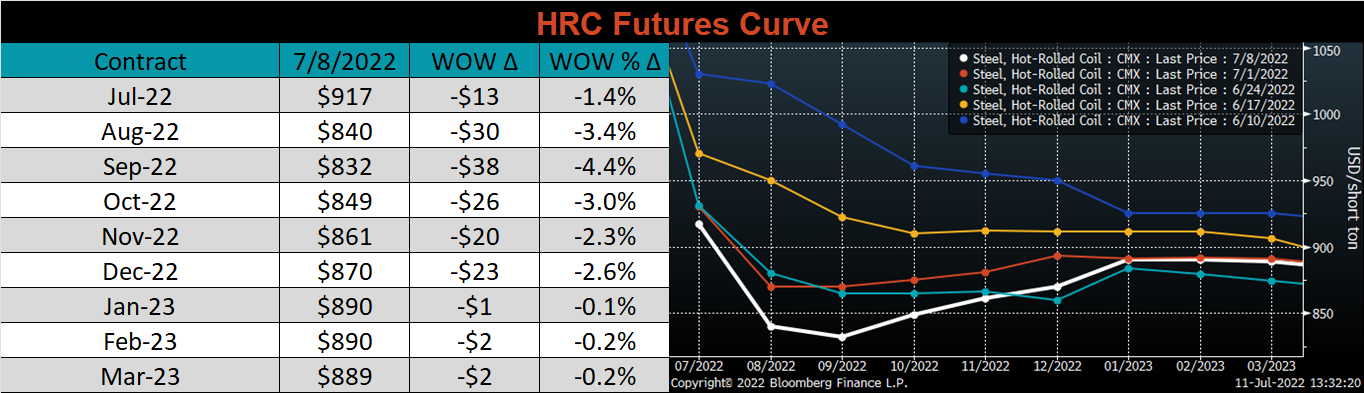

This week represents a further divergence between spot prices and the forward curve. HRC spot was down another $40 or 4.3%, while the 2nd month future price rose $38 or 4.4%.

Steel Hedging | Steel Futures | Steel Price Risk Management

Steel Trading | Voluntary Carbon Credits

The steel market has shown a noticeable shift in recent weeks, with spot prices declining and converging with the forward curve. Analysis reveals a strong relationship between the forward curve and the spot market, with futures leading spot prices by approximately one month. This suggests that the accelerated decline in steel prices brings us closer to the bottom. However, the outcome of two opposing forces—historically elevated profitability levels at mills and red-flagged inventory levels—will determine whether this signifies a respite or an impending rally in the spot market. Caution is advised when attempting to time the bottom, as recent price action serves as a reminder. Hedging at $800 HRC for 2024 material is no longer feasible.

Upside Risks:

- Reluctance to place import orders, leading to consistently subdued arrivals.

- Input costs continuing to elevate the floor for domestic producers

- China further introducing stimulus measures to bolster its construction sector

- Easing supply chain restraints and labor shortages causing an increase in activity

- Unplanned & extended planned outages causing production to fall below demand levels and cause a physical “short squeeze.”

Downside Risks:

- Rapid increases to domestic production capacity overshooting demand

- Steel consumers substitute to lower-cost alternatives

- Economic slowdown caused by increasing interest rates and sustained restrictive policy from the Federal Reserve

- Differentials rapidly increase and cause buyers to flood the domestic market with foreign material in 2H23

HRC spot prices fell sharply again this week, down another $50, or 5.3%. Over the last five weeks, the spot price is down $210, or 18.6%.

Steel Hedging | Steel Futures | Steel Price Risk Management

Steel Trading | Voluntary Carbon Credits

The latest economic data highlights the surprising resilience of the labor market, with job openings increasing to 10.1 million, surpassing expectations. The ratio of job openings to unemployed workers has also risen, indicating sustained demand. Non-farm payrolls in May exceeded expectations for the 14th consecutive month, with particular strength seen in construction payrolls reaching all-time highs. While manufacturing payrolls have plateaued recently, the overall outlook remains positive, supported by significant investments and reported skilled worker shortages. The data reaffirms a bullish long-term perspective for the manufacturing sector.

Upside Risks:

- Reluctance to place import orders, leading to consistently subdued arrivals.

- Input costs continuing to elevate the floor for domestic producers

- China further introducing stimulus measures to bolster its construction sector

- Easing supply chain restraints and labor shortages causing an increase in activity

- Unplanned & extended planned outages causing production to fall below demand levels and cause a physical “short squeeze.”

Downside Risks:

- Rapid increases to domestic production capacity overshooting demand

- Steel consumers substitute to lower-cost alternatives

- Economic slowdown caused by increasing interest rates and sustained restrictive policy from the Federal Reserve

- Differentials rapidly increase and cause buyers to flood the domestic market with foreign material in 2H23

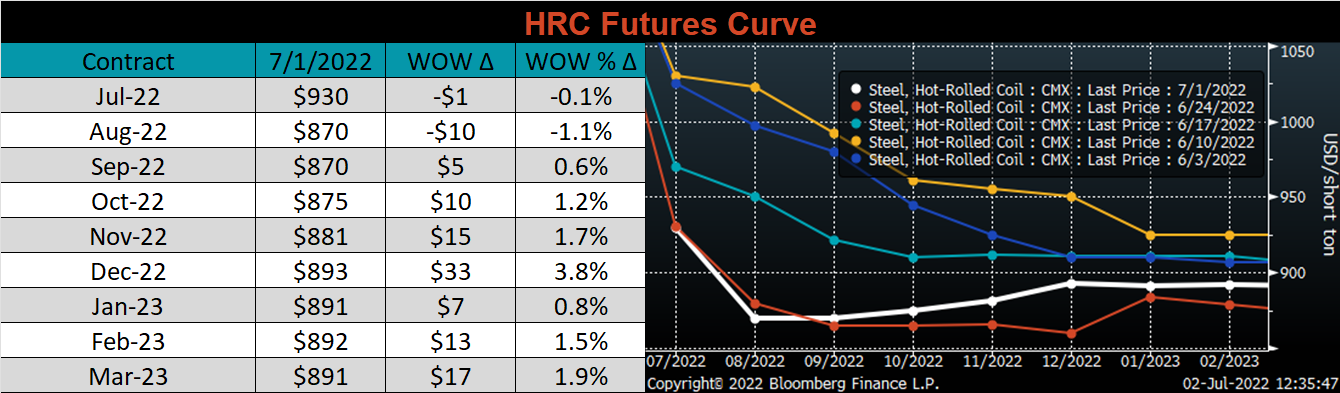

This week, the HRC 2nd month future roll, was responsible for nearly the entire move with the actual July future only down $7. The spot price was printed at $970, down $60 or 5.8% compared to last week.

Steel Hedging | Steel Futures | Steel Price Risk Management

Steel Trading | Voluntary Carbon Credits

The Regional Fed Manufacturing surveys for May indicate a deeper contraction within the sector, suggesting a decline in activity. The readings for Empire, Philadelphia, Richmond, and Dallas were below expectations, while Kansas City exceeded expectations. Prior to this data, there were signs of a turning point in the manufacturing sector, but the May data suggests a delay in the rebound. Despite the contraction, it is important to note that the manufacturing sector has only retraced about half of its previous expansion, and new construction spending on manufacturing has continued to grow rapidly, indicating potential for recovery.

Upside Risks:

- Reluctance to place import orders, leading to consistently subdued arrivals.

- Input costs continuing to elevate the floor for domestic producers

- China further introducing stimulus measures to bolster its construction sector

- Easing supply chain restraints and labor shortages causing an increase in activity

- Unplanned & extended planned outages causing production to fall below demand levels and cause a physical “short squeeze.”

Downside Risks:

- Rapid increases to domestic production capacity overshooting demand

- Steel consumers substitute to lower-cost alternatives

- Economic slowdown caused by increasing interest rates and sustained restrictive policy from the Federal Reserve

- Differentials rapidly increase and cause buyers to flood the domestic market with foreign material in 2H23

The HRC spot price was down $20 or 1.9% this week and is down 12% over the last 5 weeks. The 2nd month future (June) price was also lower this week, down $16 or 1.7%.

Steel Hedging | Steel Futures | Steel Price Risk Management

Steel Trading | Voluntary Carbon Credits

In February, we began monitoring the response of imports to positive global differentials, particularly in the context of declining domestic and international HRC prices. May data reveals an increase in orders, with elevated arrivals at 855k tpm, the highest level since August. This level is considered “normal” when comparing it to the average monthly import rate before the enactment of 232 and prior to COVID-19 shutdowns. However, a significant risk arises when delayed shipments continue to arrive after the balance of inventory has shifted into a surplus, resembling a recession in hindsight. To assess the potential downside movement of domestic HRC prices and determine a potential floor, the Houston price is a crucial data point. The relationship between Houston and Midwest prices indicates that as imports decline, the two prices diverge, and as imports increase, the spread narrows. Last week, the Houston price experienced a $60 decrease to reach $940.

Upside Risks:

- Reluctance to place import orders, leading to consistently subdued arrivals.

- Input costs continuing to elevate the floor for domestic producers

- China further introducing stimulus measures to bolster its construction sector

- Easing supply chain restraints and labor shortages causing an increase in activity

- Unplanned & extended planned outages causing production to fall below demand levels and cause a physical “short squeeze.”

Downside Risks:

- Rapid increases to domestic production capacity overshooting demand

- Steel consumers substitute to lower-cost alternatives

- Economic slowdown caused by increasing interest rates and sustained restrictive policy from the Federal Reserve

- Differentials rapidly increase and cause buyers to flood the domestic market with foreign material in 2H23

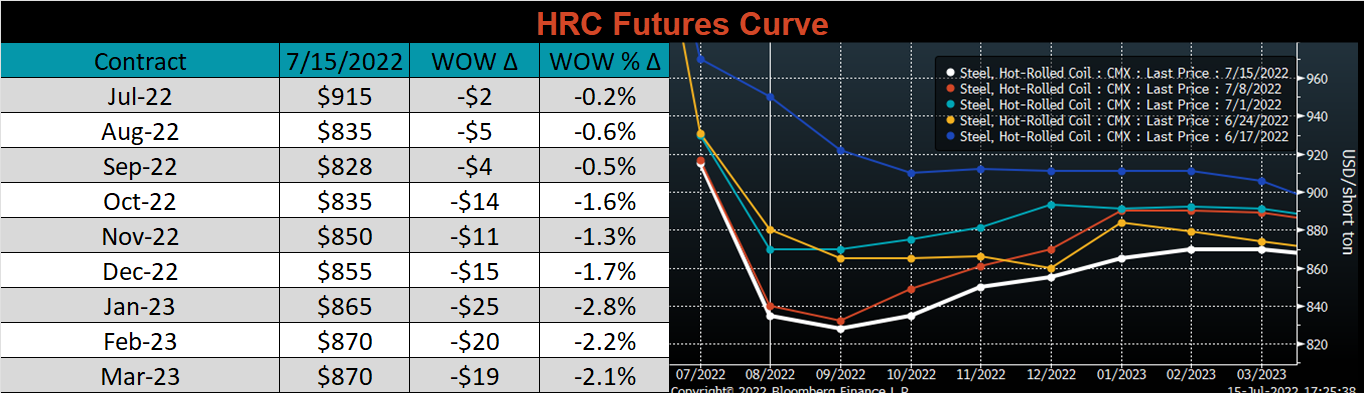

The HRC spot price was assessed sharply lower this week, down $60 or 5.4%. The increased pace of this week’s down move was nearly doubled the 5-week stretch prior, where the price was down $65 over the entire stretch. The futures market was relatively quiet again last week, with the 2nd month future (June) up $3.

Steel Hedging | Steel Futures | Steel Price Risk Management

Steel Trading | Voluntary Carbon Credits

The recent inflation data presented a mixed picture, with headline CPI coming in softer than expected, but underlying Core CPI indicating persistent inflationary pressures. This poses a complex challenge for the Federal Reserve in determining the appropriate course of action. The University of Michigan Consumer Sentiment Survey provides valuable insights, showing a sustained increase in near-term and long-term inflation expectations. These expectations, coupled with rising 5-10-year expectations reaching a 12-year high, suggest that entrenched inflation may be a growing concern. Businesses must recognize that the current economic landscape, marked by higher inflation and interest rates, may persist even after the resolution of the current crisis, as larger factors like deglobalization and supply chain realignments exert inflationary pressures. Seeking a longer-term plan to navigate these changes is crucial for business success.

Upside Risks:

- Reluctance to place import orders, leading to consistently subdued arrivals.

- Input costs continuing to elevate the floor for domestic producers

- China further introducing stimulus measures to bolster its construction sector

- Easing supply chain restraints and labor shortages causing an increase in activity

- Unplanned & extended planned outages causing production to fall below demand levels and cause a physical “short squeeze.”

Downside Risks:

- Rapid increases to domestic production capacity overshooting demand

- Steel consumers substitute to lower-cost alternatives

- Economic slowdown caused by increasing interest rates and sustained restrictive policy from the Federal Reserve

- Differentials rapidly increase and cause buyers to flood the domestic market with foreign material in 2H23

HRC spot prices continued to decline, down another $20 this week, while the 2nd month (June) future was down $6, or 0.6%.

Steel Hedging | Steel Futures | Steel Price Risk Management

Steel Trading | Voluntary Carbon Credits

This month’s data suggests that the US economy is holding up better than expected, contradicting predictions of a severe recession. The recent FOMC meeting resulted in a 25-bps rate hike, impacting interest rate-sensitive sectors like construction and autos. Construction spending has held up well, driven by non-residential growth, while the auto industry has faced challenges due to chip shortages predating the rate hikes. Concerns around demand for cars in a higher rate environment have been overpowered by the multiple year backlog. Despite concerns about higher interest rates, the economy has shown resilience.

Upside Risks:

- Reluctance to place import orders, leading to consistently subdued arrivals.

- Input costs continuing to elevate the floor for domestic producers

- China further introducing stimulus measures to bolster its construction sector

- Easing supply chain restraints and labor shortages causing an increase in activity

- Unplanned & extended planned outages causing production to fall below demand levels and cause a physical “short squeeze.”

Downside Risks:

- Rapid increases to domestic production capacity overshooting demand

- Steel consumers substitute to lower-cost alternatives

- Economic slowdown caused by increasing interest rates and sustained restrictive policy from the Federal Reserve

- Differentials rapidly increase and cause buyers to flood the domestic market with foreign material in 2H23

The HRC spot price took its first meaningful step lower since the rally began 22 weeks ago, with prices down $30 or 2.6%, last week. The 2nd month future (June) price was down slightly this week.

Steel Hedging | Steel Futures | Steel Price Risk Management

Steel Trading | Voluntary Carbon Credits

Last week’s key economic data showed slower-than-expected 1Q GDP growth, primarily due to reduced business inventories. However, consumer spending remained strong. The March PCE deflator indicated decelerating inflation overall, but core prices remained elevated. Despite recession predictions, the labor market and economy have demonstrated resilience.

Upside Risks:

- Reluctance to place import orders, leading to consistently subdued arrivals.

- Input costs continuing to elevate the floor for domestic producers

- China further introducing stimulus measures to bolster its construction sector

- Easing supply chain restraints and labor shortages causing an increase in activity

- Unplanned & extended planned outages causing production to fall below demand levels and cause a physical “short squeeze.”

Downside Risks:

- Rapid increases to domestic production capacity overshooting demand

- Steel consumers substitute to lower-cost alternatives

- Economic slowdown caused by increasing interest rates and sustained restrictive policy from the Federal Reserve

- Differentials rapidly increase and cause buyers to flood the domestic market with foreign material in 2H23

The HRC spot price was down another $10, or 0.9% this week, ending at $1,160. It is now in line with the price from 5 weeks ago. The 2nd month future was down much more sharply, but most of that decline was the result of the future rolling from May to June. The June future itself was down $35, or 3.5%, ending the week at $955.

Steel Hedging | Steel Futures | Steel Price Risk Management

Steel Trading | Voluntary Carbon Credits

Residential construction, indicated by housing starts and building permits, is a key factor for steel demand. Despite a negative reaction to rate hikes last year, permits and starts have remained strong in 2023, signaling sustained demand. March data showed mixed results, with permits down more than expected and starts declining less. However, overall activity has increased unexpectedly, benefiting steel consumption. While steel prices may decline, limited availability could keep prices relatively elevated if demand holds steady or increases.

Upside Risks:

- Reluctance to place import orders, leading to consistently subdued arrivals.

- Input costs continuing to elevate the floor for domestic producers

- China further introducing stimulus measures to bolster its construction sector

- Easing supply chain restraints and labor shortages causing an increase in activity

- Unplanned & extended planned outages causing production to fall below demand levels and cause a physical “short squeeze.”

Downside Risks:

- Rapid increases to domestic production capacity overshooting demand

- Steel consumers substitute to lower-cost alternatives

- Economic slowdown caused by increasing interest rates and sustained restrictive policy from the Federal Reserve

- Differentials rapidly increase and cause buyers to flood the domestic market with foreign material in 2H23

The HRC spot price was down $5 to $1,170 and the May future price was down $25 to $1,092.

Steel Hedging | Steel Futures | Steel Price Risk Management

Steel Trading | Voluntary Carbon Credits

Last week, inflation data showed a deceleration in upward price pressure, with both topline and core CPI readings in March lower than in February. However, a notable detail is the 3-month annualized Core CPI, which has been trending higher since December, currently at 5.2%. While this reacceleration is a concern, it remains lower than previous peaks. Additionally, the University of Michigan’s Consumer Sentiment Survey indicated higher inflation expectations, with a sharp increase in the 1-year outlook. The market is currently pricing in a 25-bps interest rate hike in the upcoming May meeting, aligning with the Federal Reserve’s summary of economic projections.

Upside Risks:

- Reluctance to place import orders,

leading to a dramatic reduction in arrivals - Increasing input costs continuing to elevate the floor for domestic producers

- China further introducing stimulus measures to bolster its construction sector

- Easing supply chain restraints and labor shortages causing an increase in activity

- Unplanned & extended planned outages causing production to fall below demand

levels and cause a physical “short squeeze.”

Downside Risks:

- Rapid increases to domestic production capacity overshooting demand

- Steel consumers substitute to lower-cost alternatives

- Economic slowdown caused by increasing interest rates and sustained restrictive policy from the Federal Reserve

- Differentials rapidly increase and cause buyers to flood the domestic market with foreign material in 2H23

The 2nd Month (May) HRC Future was up $26 or 2.4% after falling steadily for multiple weeks. The spot price remains stable at $1,175 and it has been above the 2nd month future since the last week of May.

Steel Hedging | Steel Futures | Steel Price Risk Management

Steel Trading | Voluntary Carbon Credits

The recent labor market data holds significant importance as the Federal Reserve considers when to pause its interest rate hikes. Non-farm payrolls increased at a slower pace in March but surpassed expectations for the 12th consecutive month, while the unemployment rate declined due to more people entering the labor market. Job openings remain high, contributing to upward wage pressure, and jobless claims are starting to show the expected uptick. Monitoring these dynamics will provide insights into evolving labor market conditions.

Upside Risks:

- Reluctance to place import orders,

leading to a dramatic reduction in arrivals - Increasing input costs continuing to elevate the floor for domestic producers

- China further introducing stimulus measures to bolster its construction sector

- Easing supply chain restraints and labor shortages causing an increase in activity

- Unplanned & extended planned outages causing production to fall below demand

levels and cause a physical “short squeeze.”

Downside Risks:

- Rapid increases to domestic production capacity overshooting demand

- Steel consumers substitute to lower-cost alternatives

- Economic slowdown caused by increasing interest rates and sustained restrictive policy from the Federal Reserve

- Differentials rapidly increase and cause buyers to flood the domestic market with foreign material in 2H23

After plateauing around the $1,160 price increase announcements drove U.S. domestic HRC another step higher, up 1.3% on the week. In the futures market, the May future followed the recent trend and continued to sell off, down 1.4%.

Steel Hedging | Steel Futures | Steel Price Risk Management

Steel Trading | Voluntary Carbon Credits

The recent Federal Reserve manufacturing surveys indicate a contraction in the manufacturing sector, with concerns over demand reflected in a slowdown of new orders, as well as reduced production and employment readings. Despite this data, the rally in steel prices may seem contradictory. However, the limited import arrivals and cautious production by mills, coupled with low supply and extended lead times, have contributed to the price increase. The current hot-rolled coil (HRC) price is $160 higher than five weeks ago.

Upside Risks:

- Reluctance to place import orders,

leading to a dramatic reduction in arrivals - Increasing input costs continuing to elevate the floor for domestic producers

- China further introducing stimulus measures to bolster its construction sector

- Easing supply chain restraints and labor shortages causing an increase in activity

- Unplanned & extended planned outages causing production to fall below demand

levels and cause a physical “short squeeze.”

Downside Risks:

- Rapid increases to domestic production capacity overshooting demand

- Steel consumers substitute to lower-cost alternatives

- Economic slowdown caused by increasing interest rates and sustained restrictive policy from the Federal Reserve

- Differentials rapidly increase and cause buyers to flood the domestic market with foreign material in 2H23

The HRC spot price was unchanged again, last week, while the 2nd month future was down 7.5%. A large part of the sharp move lower for the 2nd month price was the “roll” from April to May.

Steel Hedging | Steel Futures | Steel Price Risk Management

Steel Trading | Voluntary Carbon Credits

The highlight of the week was the anticipated Federal Open Market Committee (FOMC) rate decision, which resulted in a 0.25% increase in interest rates, as expected by the market. However, the preceding two weeks were turbulent, starting with Federal Reserve Chairman Jerome Powell suggesting a potential acceleration of rate hikes to 0.50% due to a strong labor market and persistent inflation. This led to a bank run on Silicon Valley Bank and concerns of economic repercussions, causing fluctuations in market expectations. Looking ahead, the impact of interest rate decisions by the Federal Reserve is significant. The median projection suggests one more rate hike in 2023, followed by a pause, with slightly higher inflation expectations. This contrasts with market expectations of multiple rate cuts in the coming years, indicating a divergence in outlook. The implications for steel in the short and long term are uncertain, as positive GDP growth may boost demand, but the unprecedented pace of rate hikes and tighter credit conditions require careful risk management.

Upside Risks:

- Reluctance to place import orders,

leading to a dramatic reduction in arrivals - Increasing input costs continuing to elevate the floor for domestic producers

- China further introducing stimulus measures to bolster its construction sector

- Easing supply chain restraints and labor shortages causing an increase in activity

- Unplanned & extended planned outages causing production to fall below demand

levels and cause a physical “short squeeze.”

Downside Risks:

- Rapid increases to domestic production capacity overshooting demand

- Steel consumers substitute to lower-cost alternatives

- Economic slowdown caused by increasing interest rates and sustained restrictive policy from the Federal Reserve

- Differentials rapidly increase and cause buyers to flood the domestic market with foreign material in 2H23

Domestic HRC prices were unchanged in the spot market last week with very little activity. On the future’s side, the 2nd month future (April) was down 3.3%. Since March 9th, the day before Silicon Valley Bank collapsed, the front 6 months of futures contracts have fallen 10.9%.

Steel Hedging | Steel Futures | Steel Price Risk Management

Steel Trading | Voluntary Carbon Credits

While the financial sector struggles for clarity after several weeks of extreme uncertainty, the steel market sits in a very similar position. The construction industry showed some signs of improving demand as both building permits and housing starts moved higher in February, reversing several months of declines in both. While this data does not reflect the recent turmoil in the banking sector, this does signal an improved outlook, especially if the hiking cycle from the Federal Reserve is coming to an end earlier than previously expected. We strongly suggest paying attention to the relationship between imports and domestic production. Measures for both have increases as inventories have shrunken. While significant uncertainty remains, looking back it is abundantly clear reluctant buyers lost their gamble for the 1st quarter of the year.

Upside Risks:

- Reluctance to place import orders,

leading to a dramatic reduction in arrivals - Increasing input costs continuing to elevate the floor for domestic producers

- China further introducing stimulus measures to bolster its construction sector

- Easing supply chain restraints and labor shortages causing an increase in activity

- Unplanned & extended planned outages causing production to fall below demand

levels and cause a physical “short squeeze.”

Downside Risks:

- Rapid increases to domestic production capacity overshooting demand

- Steel consumers substitute to lower-cost alternatives

- Economic slowdown caused by increasing interest rates and sustained restrictive policy from the Federal Reserve

- Differentials rapidly increase and cause buyers to flood the domestic market with foreign material in 2H23

Domestic HRC increased further in the spot market, up 5.5%, while the 2nd month (April) future lost 2.6%. Lead times pushed out further this week and suggest there is further upward momentum in spot pricing.

Steel Hedging | Steel Futures | Steel Price Risk Management

Steel Trading | Voluntary Carbon Credits

The domestic market remains high with raw material prices climbing. The most notable developments in the US economy revolve around uncertainty following the failure of Silicon Valley Bank. This marks the largest bank failure in the US since the Great Financial Crisis, and has market participants on edge looking forward. The Fed has tightened with the goal of pumping the breaks on the economy to bring down inflation or something breaks. While inflation remains elevated, the Fed will have to decide whether to pause and look for more clues as to the impact of the past rate hikes, or keep tightening amid uncertain conditions.

Upside Risks:

- Reluctance to place import orders,

leading to a dramatic reduction in arrivals - Increasing input costs continuing to elevate the floor for domestic producers

- China further introducing stimulus measures to bolster its construction sector

- Easing supply chain restraints and labor shortages causing an increase in activity

- Unplanned & extended planned outages causing production to fall below demand

levels and cause a physical “short squeeze.”

Downside Risks:

- Rapid increases to domestic production capacity overshooting demand

- Steel consumers substitute to lower-cost alternatives

- Economic slowdown caused by increasing interest rates and sustained restrictive policy from the Federal Reserve

- Differentials rapidly increase and cause buyers to flood the domestic market with foreign material in 2H23

The HRC assessed spot price stalled last week at $1,100. Upward momentum in this price remains well intact with lead times pushing out further on the week.

Steel Hedging | Steel Futures | Steel Price Risk Management

Steel Trading | Voluntary Carbon Credits

Steel mills across North America and Europe continue with more price hike announcements. However, a separate focus in current pricing is the policy of the Federal Reserve. Inflation data continues to come in well above the Fed’s 2% target. Moving forward, we still expect price action in steel to be driven by imbalances in supply and demand. Import and production are at two year lows, while backlogs in the auto sector have resulted in a shortage of material. This imbalance will pair with the Federal Reserve raising rates to slow demand. We anticipate a reluctance from mills to oversupply the market.

Upside Risks:

- Reluctance to place import orders,

leading to a dramatic reduction in arrivals - Increasing input costs continuing to elevate the floor for domestic producers

- China further introducing stimulus measures to bolster its construction sector

- Easing supply chain restraints and labor shortages causing an increase in activity

- Unplanned & extended planned outages causing production to fall below demand

levels and cause a physical “short squeeze.”

Downside Risks:

- Rapid increases to domestic production capacity overshooting demand

- Steel consumers substitute to lower-cost alternatives

- Economic slowdown caused by increasing interest rates and sustained restrictive policy from the Federal Reserve

- Differentials rapidly increase and cause buyers to flood the domestic market with foreign material in 2H23

U.S. Domestic HRC future and spot prices printed significantly higher last week. A flurry of mill price increase announcements culminated in a 21% increase in the March future and 17.6% increase in the spot price.

Steel Hedging | Steel Futures | Steel Price Risk Management

Steel Trading | Voluntary Carbon Credits

The construction market remains the bellwether in a rising rate environment. Housing starts remain low and below building permits. Overall, the domestic construction market has now made it’s way back to pre-pandemic levels. If construction is in fact stabilizing after months of declining activity, this is a positive signal for the broader market.

Upside Risks:

- Reluctance to place import orders,

leading to a dramatic reduction in arrivals - Increasing input costs continuing to elevate the floor for domestic producers

- China further introducing stimulus measures to bolster its construction sector

- Easing supply chain restraints and labor shortages causing an increase in activity

- Unplanned & extended planned outages causing production to fall below demand

levels and cause a physical “short squeeze”

Downside Risks:

- Rapid increases to domestic production capacity

overshooting demand - Steel consumers substitute to lower-cost alternatives

- Economic slowdown caused by increasing interest rates and sustained restrictive policy from the Federal Reserve

- Increasing differentials leading to better opportunities to purchase material abroad

The domestic HRC spot price rally continues to pick up steam, up 3.7% on the week, and 16.4% over the last 5 weeks. This is mirrored in the futures market with the 2nd month future up 4.1% on the week, and up 16.5% over the last 5 weeks.

Steel Hedging | Steel Futures | Steel Price Risk Management

Steel Trading | Voluntary Carbon Credits

February imports are looking low after the first week of data. Based on current projections, we expect sheet arrivals to come in at 732k tons, well below the post-232/pre-pandemic average. This is extremely supportive for higher domestic prices in the short term. The outlook for imports continues to be constrained. As long as this remains, the domestic market as plenty of runway for higher steel prices.

Upside Risks:

- Reluctance to place import orders,

leading to a dramatic reduction in arrivals - Increasing input costs continuing to elevate the floor for domestic producers

- China further introducing stimulus measures to bolster its construction sector

- Easing supply chain restraints and labor shortages causing an increase in activity

- Unplanned & extended planned outages causing production to fall below demand

levels and cause a physical “short squeeze”

Downside Risks:

- Rapid increases to domestic production capacity

overshooting demand - Steel consumers substitute to lower-cost alternatives

- Economic slowdown caused by increasing interest rates and sustained restrictive policy from the Federal Reserve

- Increasing differentials leading to better opportunities to purchase material abroad

U.S. Domestic HRC was up another $35 last week to $820 s.ton. This is the 11th straight week of increasing domestic spot pricing. Domestic mills continue to be aggressive with price increase announcements, but fundamental support still suggests higher prices are ahead.

Steel Hedging | Steel Futures | Steel Price Risk Management

Steel Trading | Voluntary Carbon Credits

The latest economic data continues to reflect slowing construction and manufacturing sectors. Despite the overall ISM Manufacturing PMI printing in contraction territory, the auto sector showed some improvement. January data does not give a clear picture for the overall economy as the labor market remains strong despite weakening manufacturing data.

Upside Risks:

- Reluctance to place import orders,

leading to a dramatic reduction in arrivals - Increasing input costs continuing to elevate the floor for domestic producers

- China further introducing stimulus measures to bolster its construction sector

- Easing supply chain restraints and labor shortages causing an increase in activity

- Unplanned & extended planned outages causing production to fall below demand

levels and cause a physical “short squeeze”

Downside Risks:

- Rapid increases to domestic production capacity

overshooting demand - Steel consumers substitute to lower-cost alternatives

- Economic slowdown caused by increasing interest rates and sustained restrictive policy from the Federal Reserve

- Increasing differentials leading to better opportunities to purchase material abroad

U.S. Domestic HRC was up another $5 last week and has now increased for 10 straight weeks. The initial catalyst for the rally was price increase announcements from the domestic mills, but it has found fundamental support from increasing global steel prices, higher input costs, and better than anticipated demand.

Steel Hedging | Steel Futures | Steel Price Risk Management

Steel Trading | Voluntary Carbon Credits

As steel prices rally, US manufacturing data continues a structural downtrend. Over the next 6 months, our view is that the Federal Reserve and rate decisions will be the most important factor for steel consumption as well as the entire domestic economy.

Upside Risks:

- A sudden dovish shift in financial policy leading to less aggressive rate hikes

- Strategic outages overshooting and causing production to fall below demand levels

- Easing supply chain restraints and labor shortages causing an increase in activity

- Energy issues abroad curtailing global production

- China reopening its economy with further stimulus measures

Downside Risks:

- Economic slowdown caused by increasing interest rates and sustained restrictive policy from the Federal Reserve

- Decreasing input costs allowing mills to aggressively sell lower while remaining profitable

- Increased domestic production capacity leading to an increase in competitive pricing

- Sustained levels of import arrivals keeping pressure on domestic mill pricing

- Limited desire to restock and persistently short lead times causing a “Buyer’s Strike”

The Platts TSI Daily Midwest HRC Index was up another $40 this week, ending at $780.

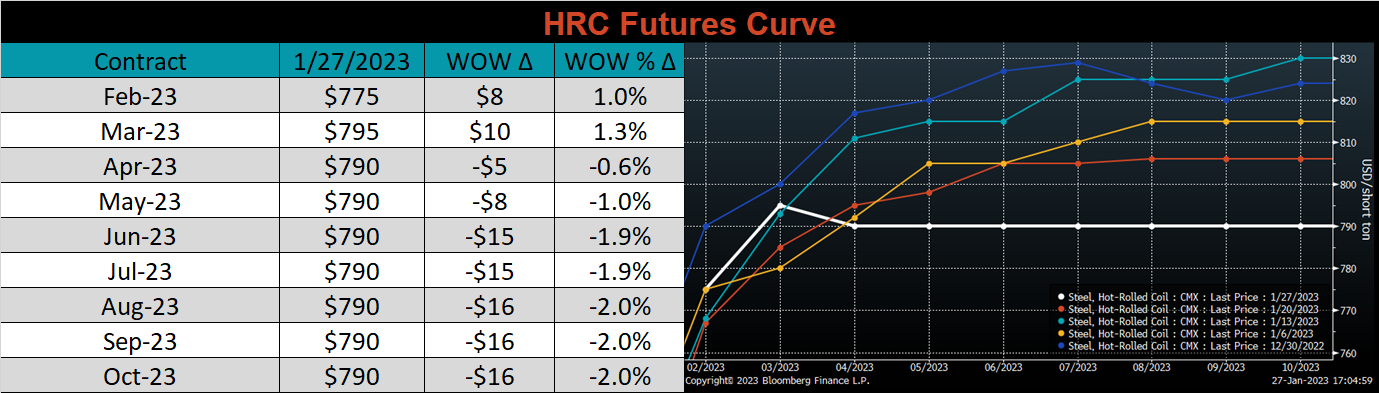

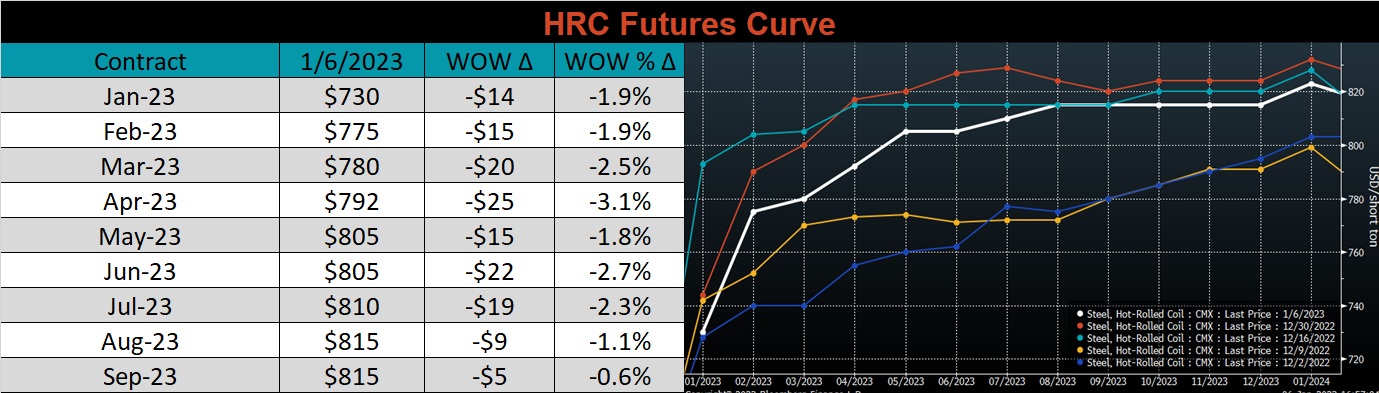

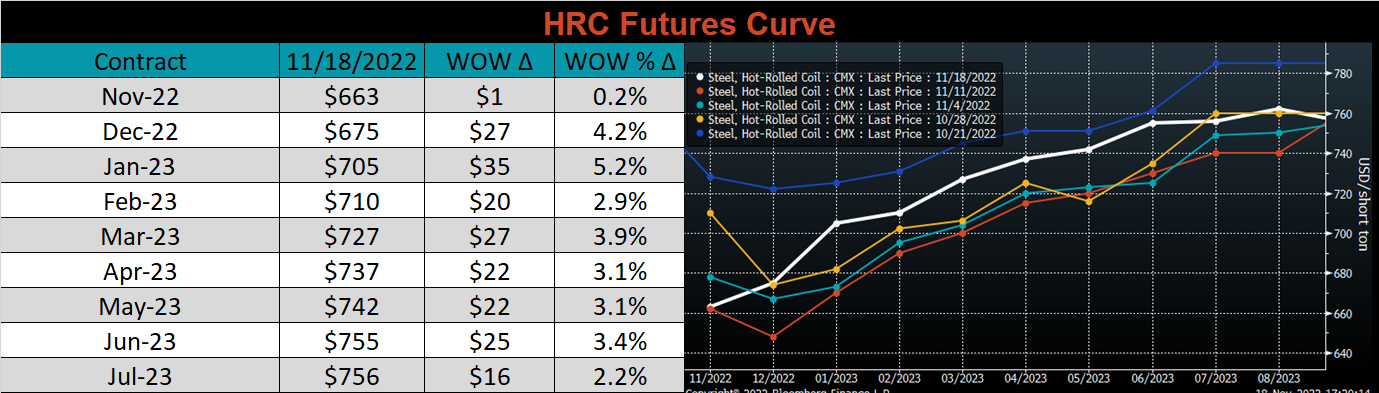

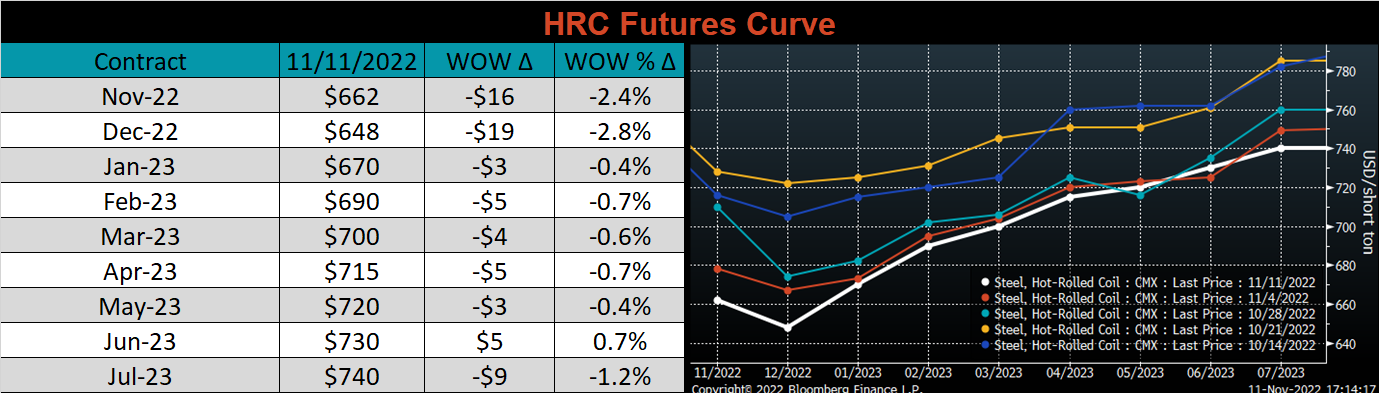

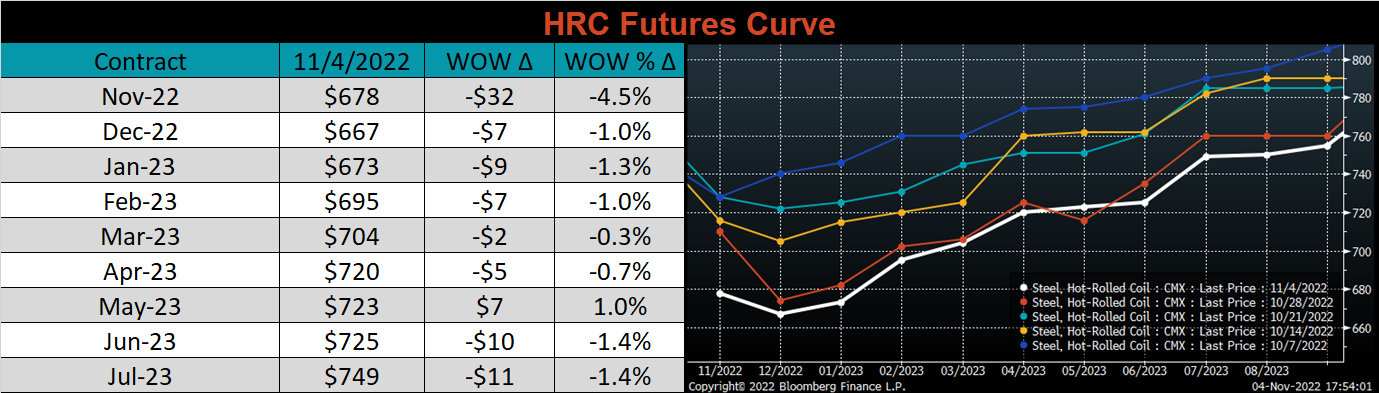

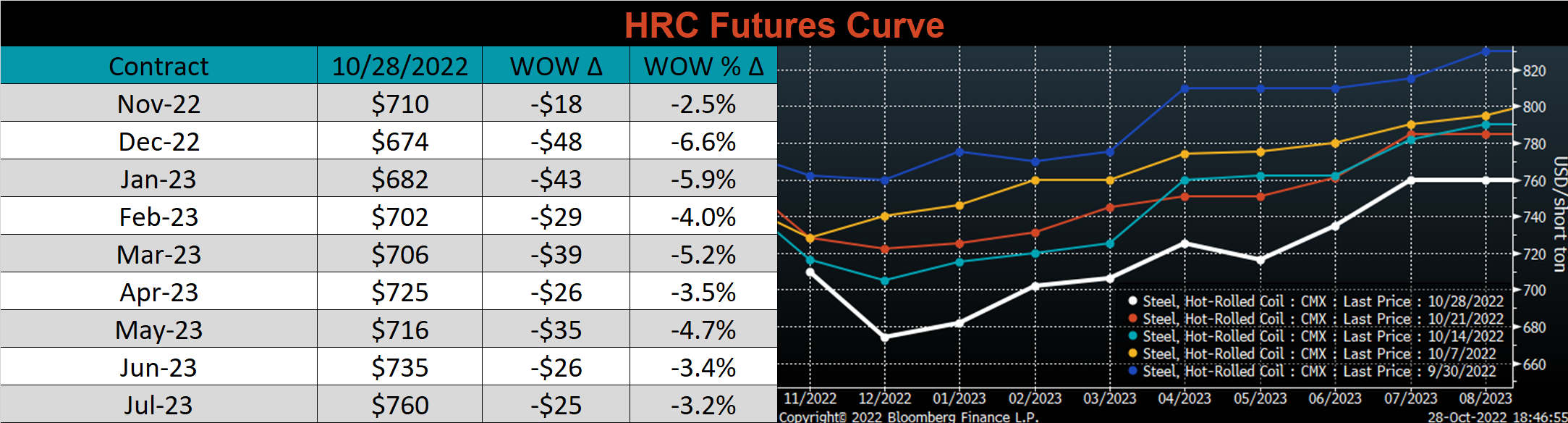

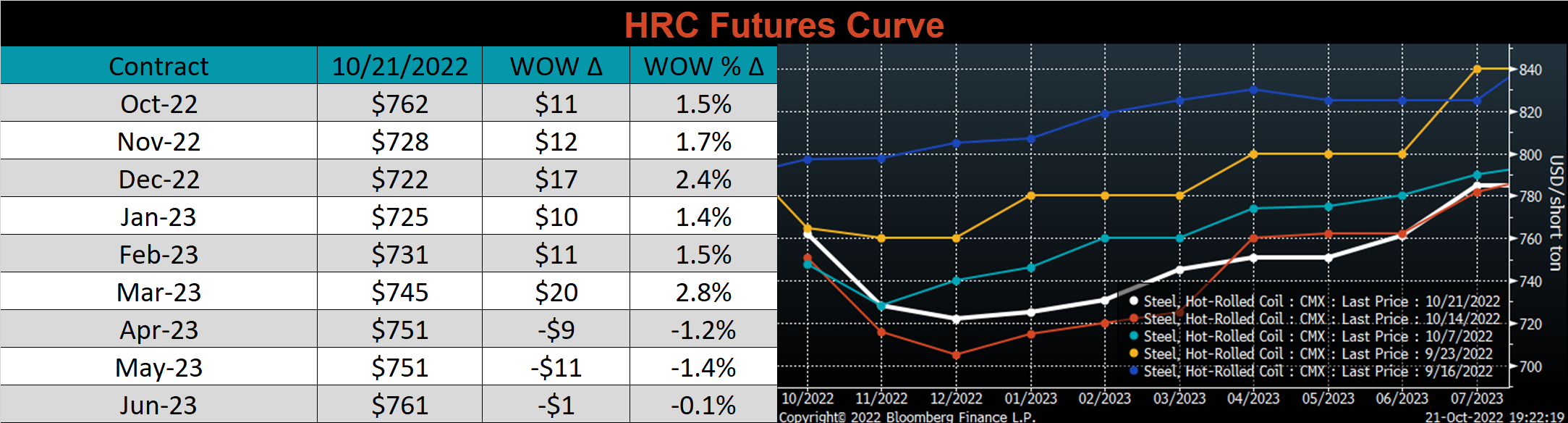

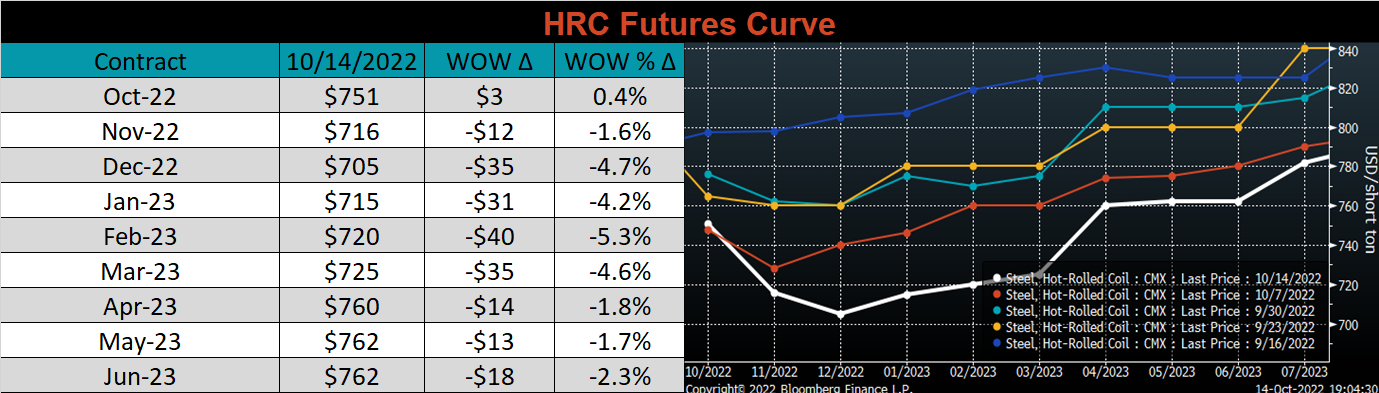

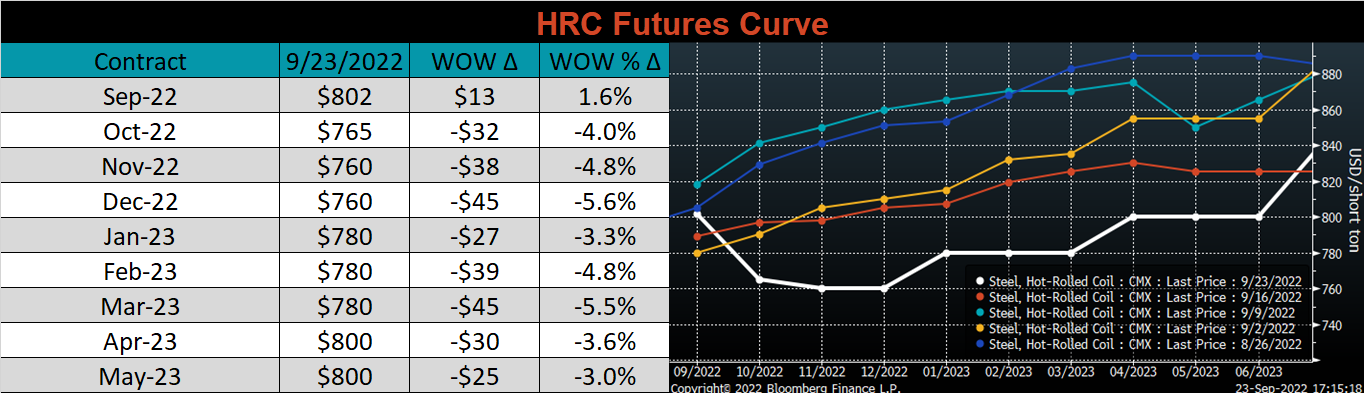

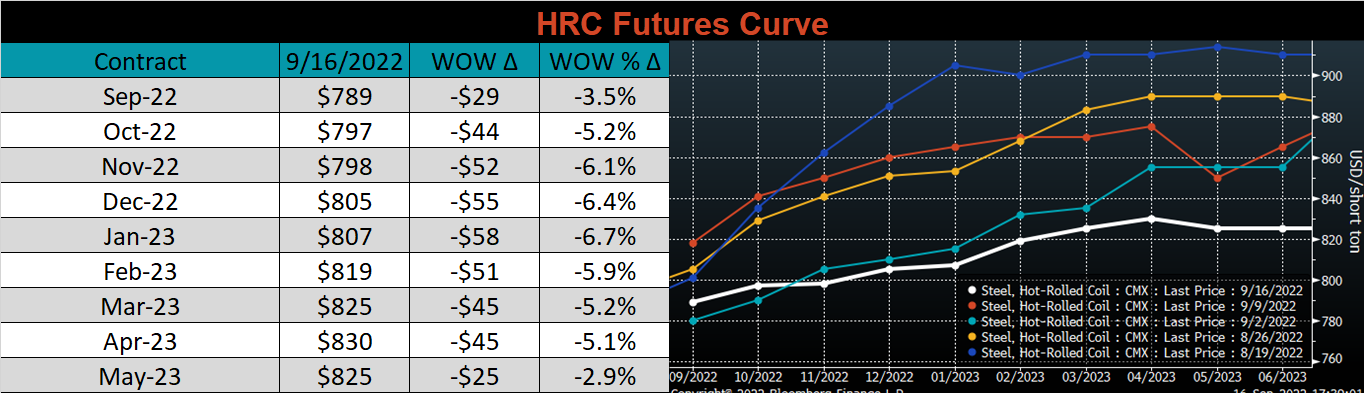

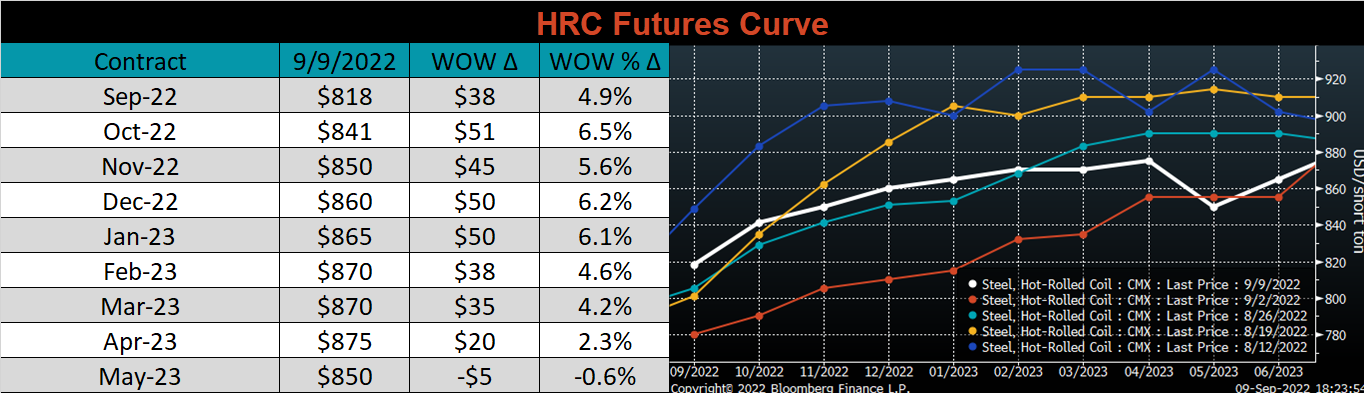

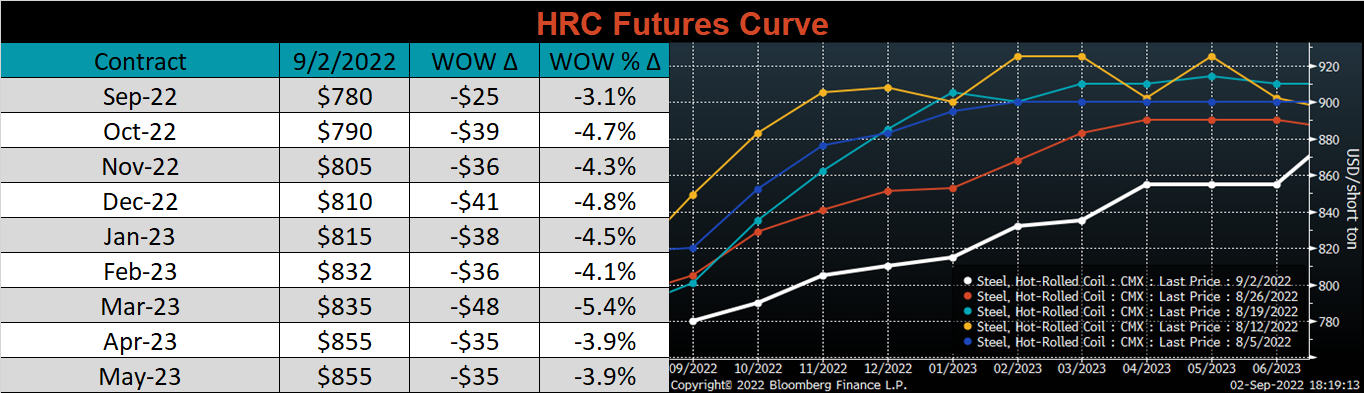

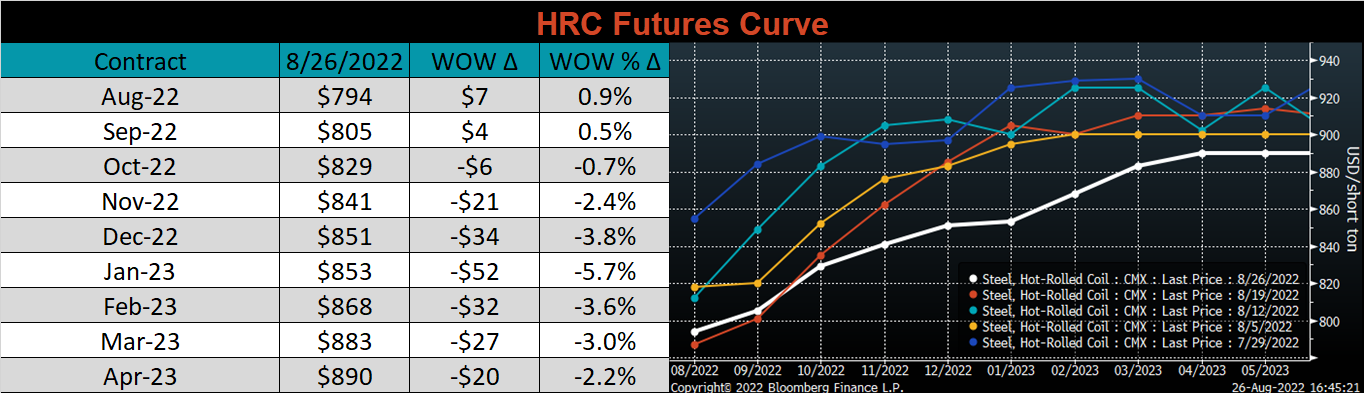

The CME Midwest HRC futures curve is below, with last Friday’s settlements in white. The front of the curve was higher, while the back fell. This movement resulted in a flat curve from April 2023 onward.

Steel Hedging | Steel Futures | Steel Price Risk Management

Steel Trading | Voluntary Carbon Credits

While housing starts and building permits have trended down since early 2022, both remain well above levels seen in the decade leading up to the pandemic. This reflects continued strength in residential construction, despite the downward trend. As the Federal Reserve continues to tighten, the interest rate sensitive housing sector will serve as a key leading indicator for a broader economic slowdown.

Upside Risks:

- A sudden dovish shift in financial policy leading to less aggressive rate hikes

- Strategic outages overshooting and causing production to fall below demand levels

- Easing supply chain restraints and labor shortages causing an increase in activity

- Energy issues abroad curtailing global production

- China reopening its economy with further stimulus measures

Downside Risks:

- Economic slowdown caused by increasing interest rates and sustained restrictive policy from the Federal Reserve

- Decreasing input costs allowing mills to aggressively sell lower while remaining profitable

- Increased domestic production capacity leading to an increase in competitive pricing

- Sustained levels of import arrivals keeping pressure on domestic mill pricing

- Limited desire to restock and persistently short lead times causing a “Buyer’s Strike”

The Platts TSI Daily Midwest HRC Index was up another $10 this week, ending at $740.

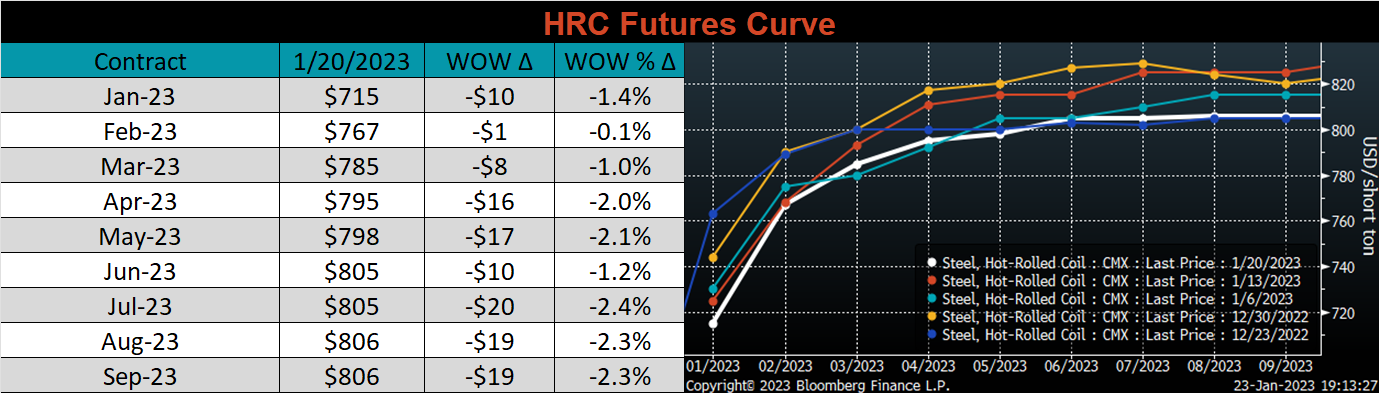

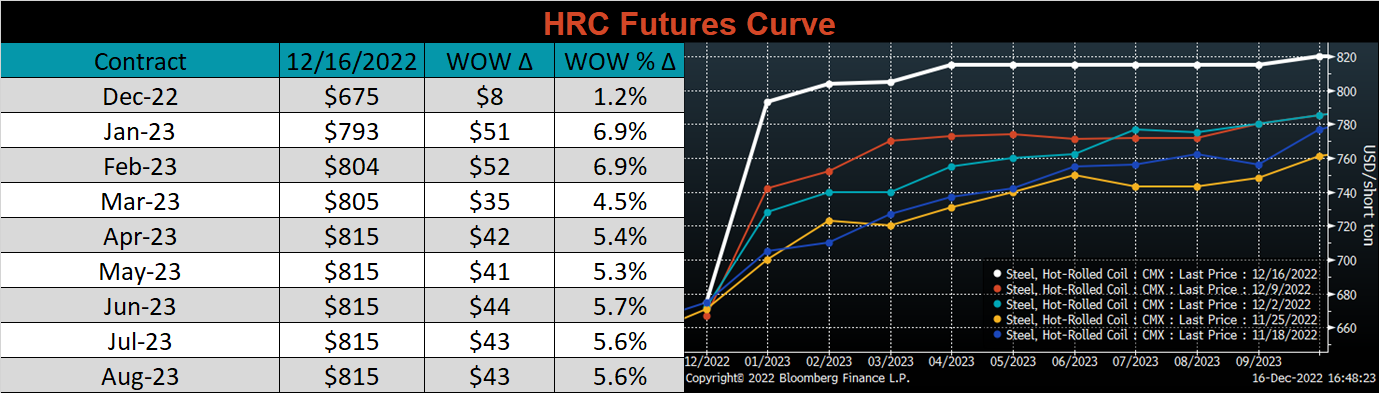

The CME Midwest HRC futures curve is below, with last Friday’s settlements in white.

Steel Hedging | Steel Futures | Steel Price Risk Management

Steel Trading | Voluntary Carbon Credits

Lagged durable goods data is showing weakness in the manufacturing sector. While still above pre-pandemic levels, new orders and shipments have fallen for 4 of the last five months. The Federal Reserve continues to tighten interest rates with the goal of slowing the economy and bringing down inflation.

Upside Risks:

- A sudden dovish shift in financial policy leading to less aggressive rate hikes

- Strategic outages overshooting and causing production to fall below demand levels

- Easing supply chain restraints and labor shortages causing an increase in activity

- Energy issues abroad curtailing global production

- China reopening its economy with further stimulus measures

Downside Risks:

- Economic slowdown caused by increasing interest rates and sustained restrictive policy from the Federal Reserve

- Decreasing input costs allowing mills to aggressively sell lower while remaining profitable

- Increased domestic production capacity leading to an increase in competitive pricing

- Sustained levels of import arrivals keeping pressure on domestic mill pricing

- Limited desire to restock and persistently short lead times causing a “Buyer’s Strike”

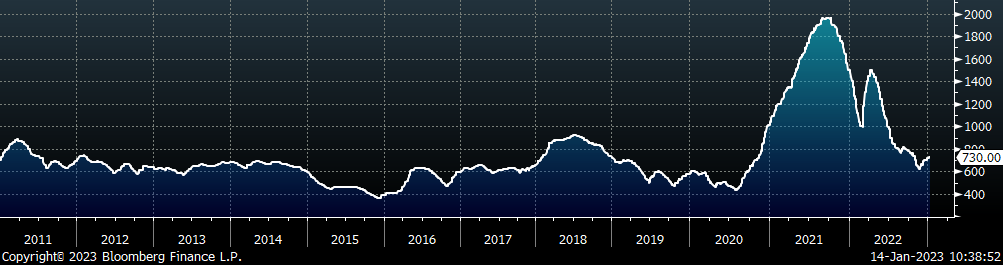

The Platts TSI Daily Midwest HRC Index was up another $10 this week, ending at $730.

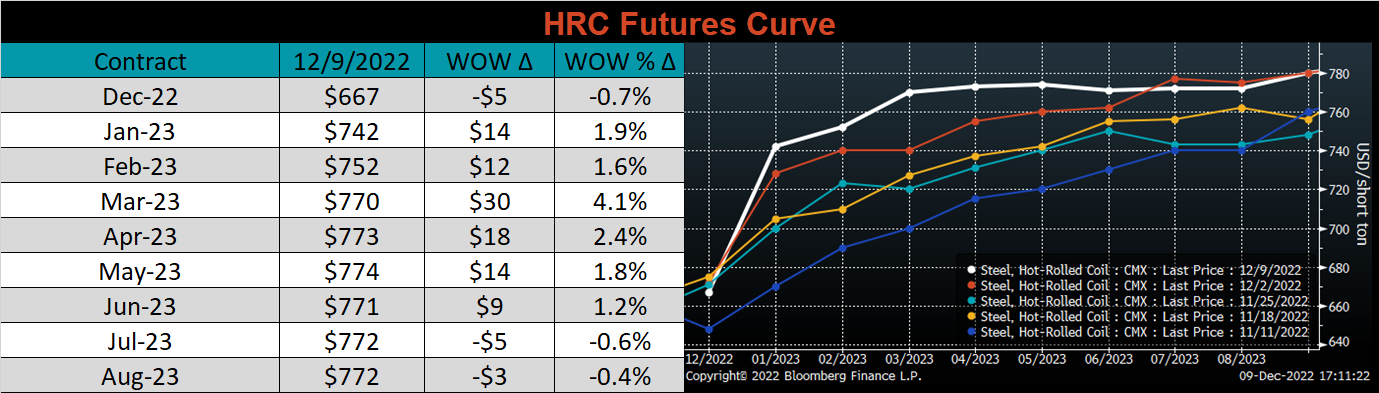

The CME Midwest HRC futures curve is below, with last Friday’s settlements in white. The front of the curve ended the week lower, while the back of the curve increased.

Steel Hedging | Steel Futures | Steel Price Risk Management

Steel Trading | Voluntary Carbon Credits

The ISM Manufacturing PMI has remained in contraction territory since October. After two year of expansion, this is indicative of a significant slowdown in the steel consuming sectors. However, while supply has fallen at the same time. Domestic production is now at the lowest levels since October 2016 (excluding the pandemic).

Upside Risks:

- A sudden dovish shift in financial policy leading to less aggressive rate hikes

- Strategic outages overshooting and causing production to fall below demand levels

- Easing supply chain restraints and labor shortages causing an increase in activity

- Energy issues abroad curtailing global production

- China reopening its economy with further stimulus measures

Downside Risks:

- Economic slowdown caused by increasing interest rates and sustained restrictive policy from the Federal Reserve

- Decreasing input costs allowing mills to aggressively sell lower while remaining profitable

- Increased domestic production capacity leading to an increase in competitive pricing

- Sustained levels of import arrivals keeping pressure on domestic mill pricing

- Limited desire to restock and persistently short lead times causing a “Buyer’s Strike”

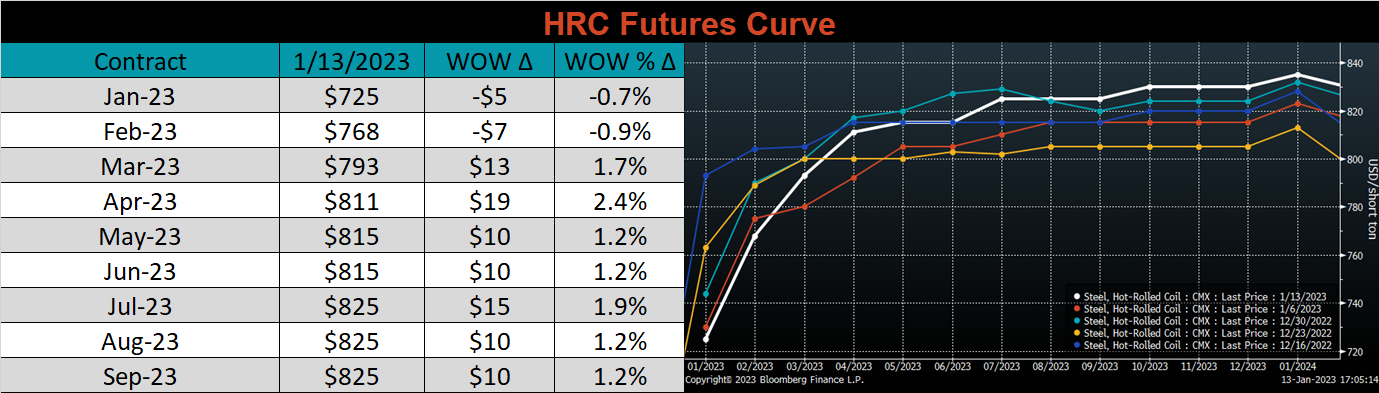

The Platts TSI Daily Midwest HRC Index was up another $20 this week, ending at $720.

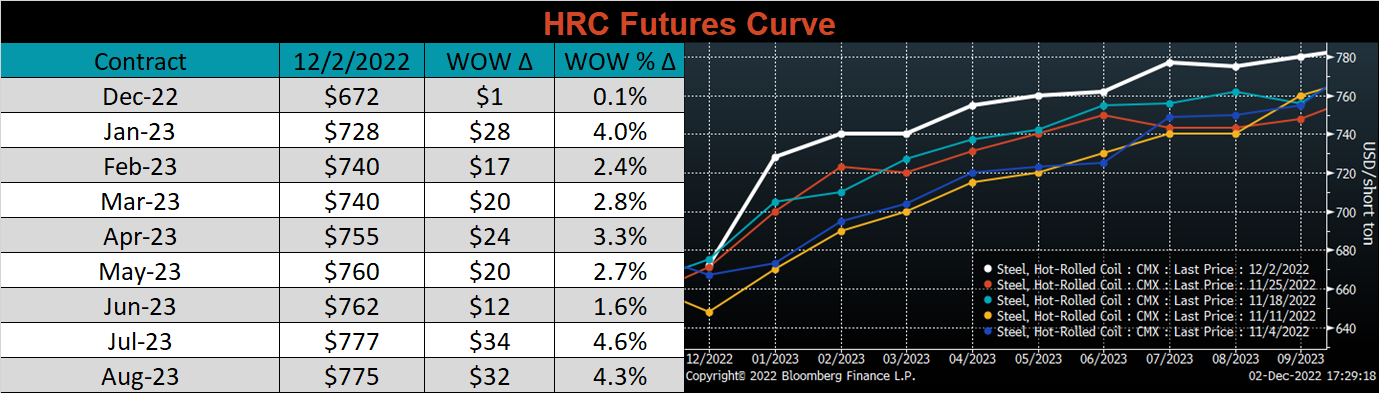

The CME Midwest HRC futures curve is below, with last Friday’s settlements in white. The entire curve ended the week lower, most significantly in the front.

Steel Hedging | Steel Futures | Steel Price Risk Management

Steel Trading | Voluntary Carbon Credits

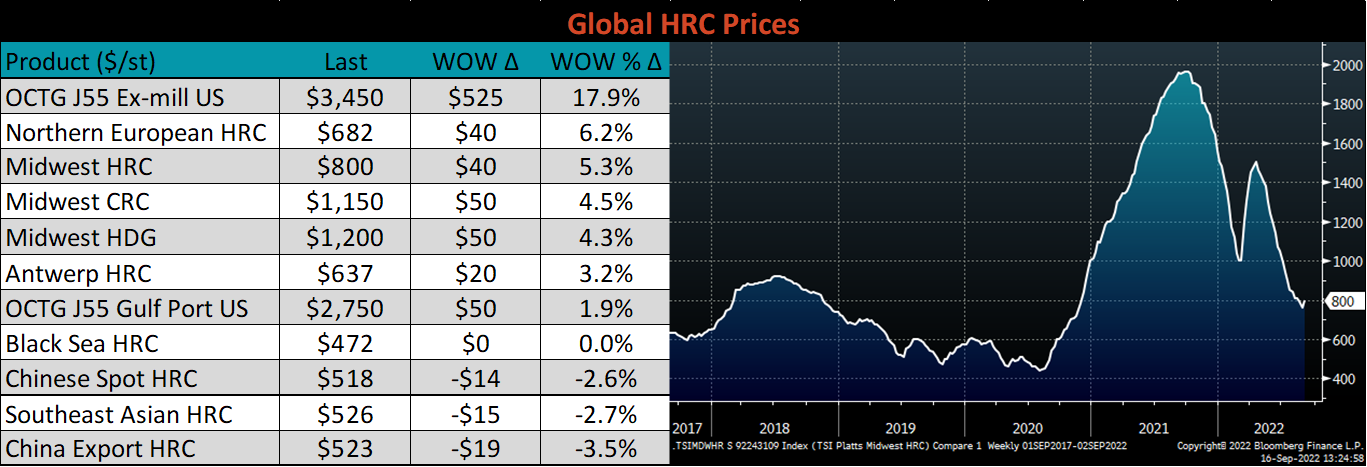

The Chinese export price continues to rise. Adjusting for transportation and tariffs, the U.S. price is not relatively cheap compared to Chinese export HRC. Historically, this is a bullish short term signal for domestic prices. It is unlikely that domestic producers will be undercut by global producers, and domestic prices could increase in the near future. This is supported when one examines the U.S. Houston HRC price compared to the U.S. Midwest HRC price. The Houston price is more driven by import arrivals than the Midwest price. The Houston price has rallied in recent weeks with global prices.

Upside Risks:

- A sudden dovish shift in financial policy leading to less aggressive rate hikes

- Strategic outages overshooting and causing production to fall below demand levels

- Easing supply chain restraints and labor shortages causing an increase in activity

- Energy issues abroad curtailing global production

- China reopening its economy with further stimulus measures

Downside Risks:

- Economic slowdown caused by increasing interest rates and sustained restrictive policy from the Federal Reserve

- Decreasing input costs allowing mills to aggressively sell lower while remaining profitable

- Increased domestic production capacity leading to an increase in competitive pricing

- Sustained levels of import arrivals keeping pressure on domestic mill pricing

- Limited desire to restock and persistently short lead times causing a “Buyer’s Strike”

The Platts TSI Daily Midwest HRC Index was up another $20 this week, ending at $670.

The CME Midwest HRC futures curve is below, with last Friday’s settlements in white. The front of the curve was higher this week, while 2Q23 and beyond are flat around $770.

Steel Hedging | Steel Futures | Steel Price Risk Management

Steel Trading | Voluntary Carbon Credits

Steel mills announced recent price hikes. In addition to these hikes, lead times have stabilized and are starting to push out global prices. Raw material costs have started to climb for both EAF and BOF mills. Over the past three weeks, our “basket” of raw materials has increased by 9.1%, the most significant short term move since May 2021.

Upside Risks:

- A sudden dovish shift in financial policy leading to less aggressive rate hikes

- Strategic outages overshooting and causing production to fall below demand levels

- Easing supply chain restraints and labor shortages causing an increase in activity

- Energy issues abroad curtailing global production

- China reopening its economy with further stimulus measures

Downside Risks:

- Economic slowdown caused by increasing interest rates and sustained restrictive policy from the Federal Reserve

- Decreasing input costs allowing mills to aggressively sell lower while remaining profitable

- Increased domestic production capacity leading to an increase in competitive pricing

- Sustained levels of import arrivals keeping pressure on domestic mill pricing

- Limited desire to restock and persistently short lead times causing a “Buyer’s Strike”

The Platts TSI Daily Midwest HRC Index was up another $20 this week, ending at $690.

The CME Midwest HRC futures curve is below, with last Friday’s settlements in white. The entire curve was higher this week, most significantly in the front. The ended the week flat around $800-820 level for 2023.

Steel Hedging | Steel Futures | Steel Price Risk Management

Steel Trading | Voluntary Carbon Credits

The Federal Reserve continues to hike rates, hoping to slow the economy and bring inflation down. This month’s data shows depressed demand from manufacturing, construction, and auto sectors. Within steel, customer inventories are at their highest levels since April 2020. Buyers have taken advantage of low prices and will need to work through inventories before restocking in large quantities.

Upside Risks:

- A sudden dovish shift in financial policy leading to less aggressive rate hikes

- Strategic outages overshooting and causing production to fall below demand levels

- Easing supply chain restraints and labor shortages causing an increase in activity

- Energy issues abroad curtailing global production

- China reopening its economy with further stimulus measures

Downside Risks:

- Economic slowdown caused by increasing interest rates and sustained restrictive policy from the Federal Reserve

- Decreasing input costs allowing mills to aggressively sell lower while remaining profitable

- Increased domestic production capacity leading to an increase in competitive pricing

- Sustained levels of import arrivals keeping pressure on domestic mill pricing

- Limited desire to restock and persistently short lead times causing a “Buyer’s Strike”

The Platts TSI Daily Midwest HRC Index was up $30 this week, ending at $650. This was the first time the spot price rose in 11 weeks.

The CME Midwest HRC futures curve is below, with last Friday’s settlements in white. The entire curve shifted higher again this week.

Steel Hedging | Steel Futures | Steel Price Risk Management

Steel Trading | Voluntary Carbon Credits

The mill margin spread has moved well below historic levels. The current spread between second month HRC and Busheling futures is $265. In the four years prior to the pandemic, the average spread was $312. The current tight spreads present a significant upside risk as profit margins for the mills tighten.

Upside Risks:

- A sudden dovish shift in financial policy leading to less aggressive rate hikes

- Strategic outages overshooting and causing production to fall below demand levels

- Easing supply chain restraints and labor shortages causing an increase in activity

- Energy issues abroad curtailing global production

- China reopening its economy with further stimulus measures

Downside Risks:

- Economic slowdown caused by increasing interest rates and sustained restrictive policy from the Federal Reserve

- Decreasing input costs allowing mills to aggressively sell lower while remaining profitable

- Increased domestic production capacity leading to an increase in competitive pricing

- Sustained levels of import arrivals keeping pressure on domestic mill pricing

- Limited desire to restock and persistently short lead times causing a “Buyer’s Strike”

The Platts TSI Daily Midwest HRC Index was down another $30, ending at $620.

The CME Midwest HRC futures curve is below, with last Friday’s settlements in white. The forward curve increased at every expiration last week. This was the first time the entire curve shifted meaningfully higher in 10 weeks.

Steel Hedging | Steel Futures | Steel Price Risk Management

Steel Trading | Voluntary Carbon Credits

Since 2020, auto production has been significantly hampered by supply chain woes and the microchip shortage. Over the last 6 months, auto production has increased despite rising interest rates. High rates have been a growing headwind for demand in both manufacturing and construction sectors. However, pent up demand for automobiles could serve to bridge the gap left from a manufacturing slowdown and support falling steel prices.

Upside Risks:

- A sudden dovish shift in financial policy leading to less aggressive rate hikes

- Strategic outages overshooting and causing production to fall below demand levels

- Easing supply chain restraints and labor shortages causing an increase in activity

- Energy issues abroad curtailing global production

- China reopening its economy with further stimulus measures

Downside Risks:

- Economic slowdown caused by increasing interest rates and sustained restrictive policy from the Federal Reserve

- Decreasing input costs allowing mills to aggressively sell lower while remaining profitable

- Increased domestic production capacity leading to an increase in competitive pricing

- Sustained levels of import arrivals keeping pressure on domestic mill pricing

- Limited desire to restock and persistently short lead times causing a “Buyer’s Strike”

The Platts TSI Daily Midwest HRC Index was down another $5, ending at $650.

The CME Midwest HRC futures curve is below, with last Friday’s settlements in white. The front of the curve continued it’s recent trend and printed lower, while the remainder of the curve showed very little change.

Steel Hedging | Steel Futures | Steel Price Risk Management

Steel Trading | Voluntary Carbon Credits

Despite negative sentiment, US manufacturers have continued to produce at relatively high levels in recent months. This is evidenced by strong manufacturing Purchasing Managers’ Index (PMI) data. While new orders have fallen and inventories have risen, the topline PMI number has remained high. However, new orders and backlogs are now approaching the lowest levels since Spring 2020, suggesting a manufacturing slowdown is imminent.

Upside Risks:

- A sudden dovish shift in financial policy leading to less aggressive rate hikes

- Strategic outages overshooting and causing production to fall below demand levels

- Easing supply chain restraints and labor shortages causing an increase in activity

- Energy issues abroad curtailing global production

- China reopening its economy with further stimulus measures

Downside Risks:

- Economic slowdown caused by increasing interest rates and sustained restrictive policy from the Federal Reserve

- Decreasing input costs allowing mills to aggressively sell lower while remaining profitable

- Increased domestic production capacity leading to an increase in competitive pricing

- Sustained levels of import arrivals keeping pressure on domestic mill pricing

- Limited desire to restock and persistently short lead times causing a “Buyer’s Strike”

The Platts TSI Daily Midwest HRC Index was down sharply this week, $85 ending at $655.

The CME Midwest HRC futures curve is below, with last Friday’s settlements in white. The curve moved sharply lower in the front month, but was down only slightly on the remainder of the curve.

Steel Hedging | Steel Futures | Steel Price Risk Management

Steel Trading | Voluntary Carbon Credits

China wrapped up their 20th Party Congress this past week. Many market participants hoped that this would be the time to see China begin to ease on their restrictive COVID-zero policy stance. However, the congress only served as an opportunity to double down on the current restrictive policy. The market shows its sensitivity to Chinese demand with iron ore falling levels not seen since early May 2020.

Upside Risks:

- A sudden dovish shift in financial policy leading to less aggressive rate hikes

- Strategic outages overshooting and causing production to fall below demand levels

- China reopening its economy with further stimulus measures

- Energy issues abroad curtailing global production

- Easing supply chain restraints and labor shortages causing an increase in activity

Downside Risks:

- Economic slowdown caused by increasing interest rates and sustained restrictive policy from the Federal Reserve

- Decreasing input costs allowing mills to aggressively sell lower while remaining profitable

- Increased domestic production capacity leading to an increase in competitive pricing

- Sustained levels of import arrivals keeping pressure on domestic mill pricing

- Limited desire to restock and persistently short lead times causing a “Buyer’s Strike”

The Platts TSI Daily Midwest HRC Index was unchanged at $740.

The CME Midwest HRC futures curve is below, with last Friday’s settlements in white. The entire cure shifted sharply lower last week, most significantly in the front.

Steel Hedging | Steel Futures | Steel Price Risk Management

Steel Trading | Voluntary Carbon Credits

Despite an uptick in import arrivals last week, current imports still remain near the lowest levels since mid-2021. As a result, buyers have become far more reliant on domestic producers this year. Mills appear to be reducing their overall contract books to increase spot market activity. While we do not anticipate this having a drastic impact in the short term, there is increased risk of a short squeeze if buyers seek to restock simultaneously, in a more competitive spot market.

Upside Risks:

- A sudden dovish shift in financial policy leading to less aggressive rate hikes

- Strategic outages overshooting and causing production to fall below demand levels

- China reopening its economy with further stimulus measures

- Energy issues abroad curtailing global production

- Easing supply chain restraints and labor shortages causing an increase in activity

Downside Risks:

- Economic slowdown caused by increasing interest rates and sustained restrictive policy from the Federal Reserve

- Decreasing input costs allowing mills to aggressively sell lower while remaining profitable

- Increased domestic production capacity leading to an increase in competitive pricing

- Sustained levels of import arrivals keeping pressure on domestic mill pricing

- Limited desire to restock and persistently short lead times causing a “Buyer’s Strike”

The Platts TSI Daily Midwest HRC Index was down $20 to $740.

The CME Midwest HRC futures curve is below, with last Friday’s settlements in white. The curve was slightly higher in the front and lower in the back, leading to an overall flattening at prices just below published spot levels.

Steel Hedging | Steel Futures | Steel Price Risk Management

Steel Trading | Voluntary Carbon Credits

The Midwest assessed price has stayed relatively flat around $800 for the past month. This has been supported by decreased imports, limited purchasing options for buyers. However, sheet imports have shown an uptick in the past week. Increased imports will put pressure on mills to reduce production or compete in the market with lower prices abroad. September imports fell to the lowest level since April 2021, but the latest uptick may lead to more domestic production cuts and furnace idling.

Upside Risks:

- A sudden dovish shift in financial policy leading to less aggressive rate hikes

- Strategic outages overshooting and causing production to fall below demand levels

- China reopening its economy with further stimulus measures

- Energy issues abroad curtailing global production

- Easing supply chain restraints and labor shortages causing an increase in activity

Downside Risks:

- Economic slowdown caused by increasing interest rates and sustained restrictive policy from the Federal Reserve

- Decreasing input costs allowing mills to aggressively sell lower while remaining profitable

- Increased domestic production capacity leading to an increase in competitive pricing

- Sustained levels of import arrivals keeping pressure on domestic mill pricing

- Limited desire to restock and persistently short lead times causing a “Buyer’s Strike”

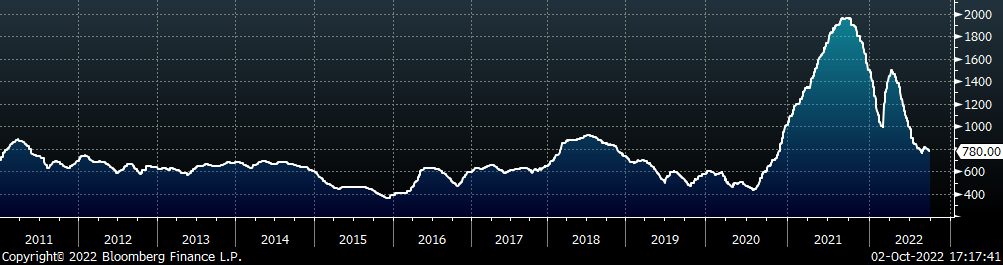

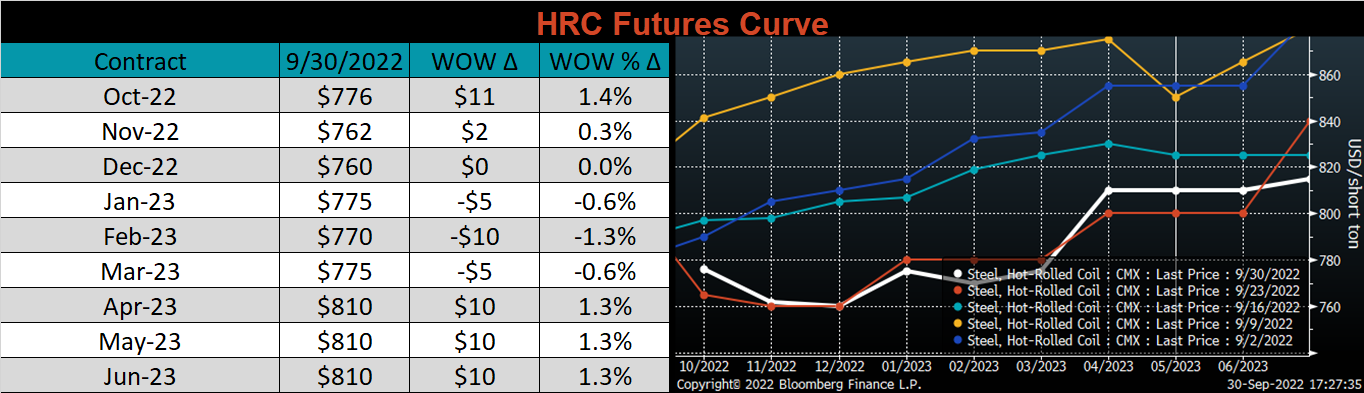

The Platts TSI Daily Midwest HRC Index was unchanged at $760.

The CME Midwest HRC futures curve is below, with last Friday’s settlements in white. The curve continues to be under significant pressure with the 4Q22 and 1Q23 both trading below current spot prices.

Steel Hedging | Steel Futures | Steel Price Risk Management

Steel Trading | Voluntary Carbon Credits

The latest manufacturing data suggests the U.S. economy remains strong, but growth continues to fade. The ISM Manufacturing PMI continues to climb while monthly construction spending fell in September for the third consecutive month. New orders and backlog’s have fallen, suggesting the headline manufacturing PMI number could follow suit in the coming months. As the market eyes the FOMC November meeting, every data point is being heavily studied by the market.

Upside Risks:

- A sudden dovish shift in financial policy leading to less aggressive rate hikes

- Strategic outages overshooting and causing production to fall below demand levels

- China reopening its economy with further stimulus measures

- Energy issues abroad curtailing global production

- Easing supply chain restraints and labor shortages causing an increase in activity

Downside Risks:

- Economic slowdown caused by increasing interest rates and sustained restrictive policy from the Federal Reserve

- Decreasing input costs allowing mills to aggressively sell lower while remaining profitable

- Increased domestic production capacity leading to an increase in competitive pricing

- Sustained levels of import arrivals keeping pressure on domestic mill pricing

- Limited desire to restock and persistently short lead times causing a “Buyer’s Strike”

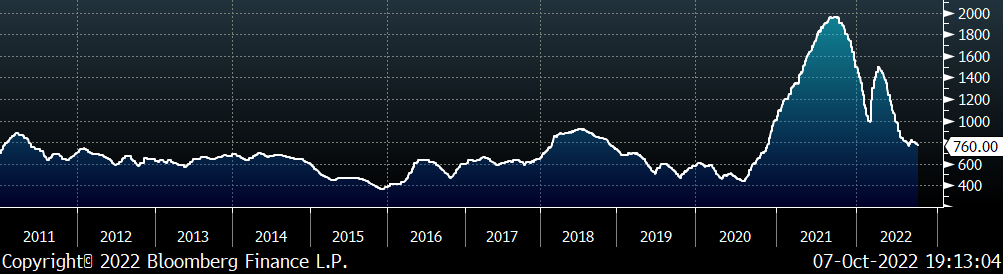

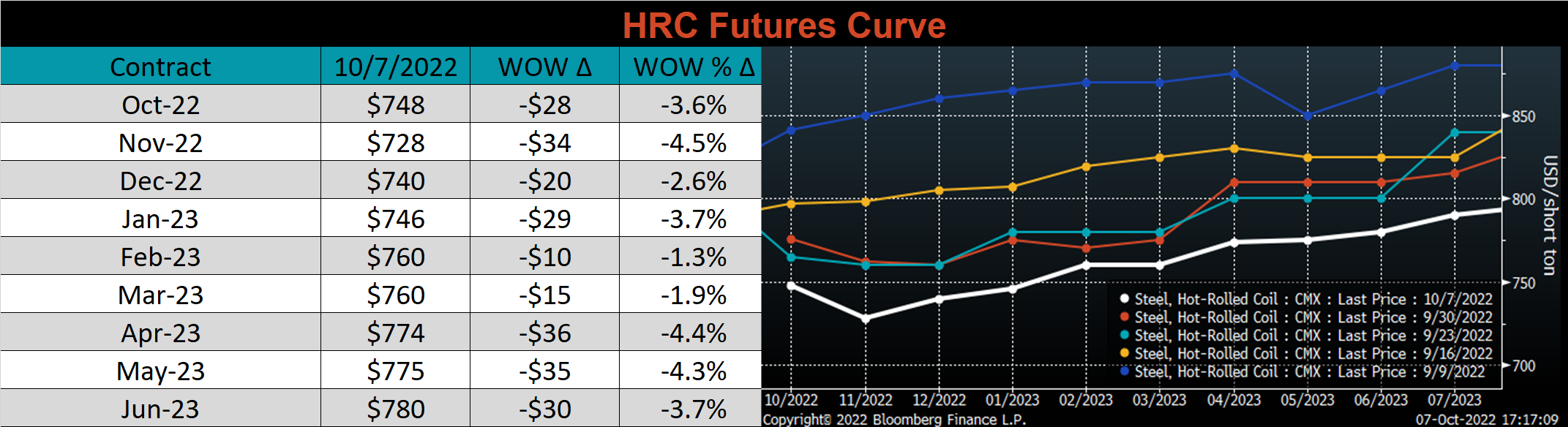

The Platts TSI Daily Midwest HRC Index was down another $20 to $760.

The CME Midwest HRC futures curve is below, with last Friday’s settlements in white. The curve continues to trend lower, with all the expirations currently trading at their lowest levels on record.

Steel Hedging | Steel Futures | Steel Price Risk Management

Steel Trading | Voluntary Carbon Credits

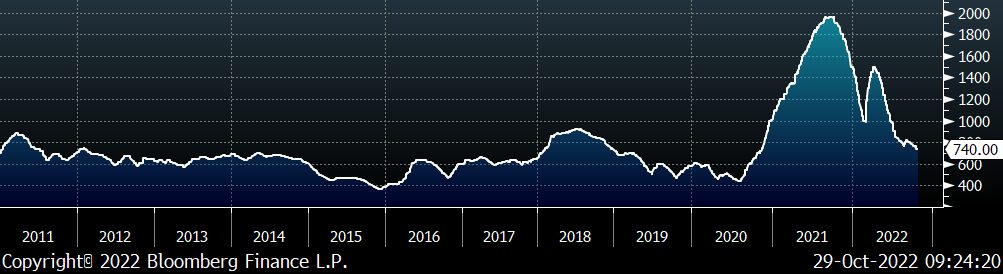

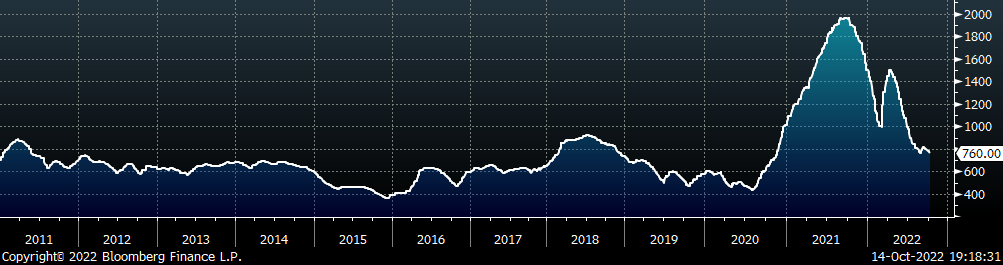

Demand for steel continues to fall on the back of worsening sentiment and outlook for the global economy. While inflation persists, rising interest rates have contributed to slowing global demand. Domestically, this has resulted in both decreased imports and production. Despite constrained supply, decreased demand has caused the HRC spot price to fall 48% from its peak in April 2022.

Upside Risks:

- A sudden dovish shift in financial policy leading to less aggressive rate hikes

- Strategic outages overshooting and causing production to fall below demand levels

- China reopening its economy with further stimulus measures

- Energy issues abroad curtailing global production

- Easing supply chain restraints and labor shortages causing an increase in activity

Downside Risks:

- Economic slowdown caused by increasing interest rates and sustained restrictive policy from the Federal Reserve

- Decreasing input costs allowing mills to aggressively sell lower while remaining profitable

- Increased domestic production capacity leading to an increase in competitive pricing

- Sustained levels of import arrivals keeping pressure on domestic mill pricing

- Limited desire to restock and persistently short lead times causing a “Buyer’s Strike”

The Platts TSI Daily Midwest HRC Index was down another $10 to $780.

The CME Midwest HRC futures curve is below, with last Friday’s settlements in white. The entire curve continued its trend over the last three weeks and shifted lower. The 1Q23 is now trading at its lowest level since the contract began trading.

Steel Hedging | Steel Futures | Steel Price Risk Management

Steel Trading | Voluntary Carbon Credits

The FOMC announced another 75 basis point hike, signifying the Feds commitment to fighting inflation and stabilizing prices moving forward, whatever the costs may be. Hawkish policy will likely have a negative impact on short term steel prices, but the production flexibility of US EAF producers will be a significant resource in matching production with demand.

Upside Risks:

- A sudden dovish shift in financial policy leading to less aggressive rate hikes

- Strategic outages overshooting and causing production to fall below demand levels

- China reopening its economy with further stimulus measures

- Energy issues abroad curtailing global production

- Easing supply chain restraints and labor shortages causing an increase in activity

Downside Risks:

- Economic slowdown caused by increasing interest rates and sustained restrictive policy from the Federal Reserve

- Decreasing input costs allowing mills to aggressively sell lower while remaining profitable

- Increased domestic production capacity leading to an increase in competitive pricing

- Sustained levels of import arrivals keeping pressure on domestic mill pricing

- Limited desire to restock and persistently short lead times causing a “Buyer’s Strike”

The Platts TSI Daily Midwest HRC Index was down another $10 to $790.

The CME Midwest HRC futures curve is below, with last Friday’s settlements in white. The entire curve continued its trend over the last three weeks and shifted lower. The 1Q23 is now trading at its lowest level since the contract began trading.

Steel Hedging | Steel Futures | Steel Price Risk Management

Steel Trading | Voluntary Carbon Credits

The spread between galvanized and hot-rolled steel has fallen for two consecutive months on relative weakness of galvanized products compared to hot-rolled. The momentum of the decline for HRC spot prices has temporarily stabilized, while HDG downward price momentum remains significant.

Upside Risks:

- Reluctance in placing import orders, leading to a dramatic reduction in arrivals

- Unplanned & extended planned outages causing production to fall below demand levels and cause a physical “short squeeze.”

- China reopening its economy with further stimulus measures

- Energy issues abroad curtailing global production

- Easing supply chain restraints and labor shortages causing an increase in activity

Downside Risks:

- Decreasing input costs allowing mills to aggressively sell lower while remaining profitable

- Increased domestic production capacity leading to an increase in competitive pricing

- Steel consumers substitute to lower-cost alternatives

- Limited desire to restock and persistently short lead times causing a “Buyer’s Strike”

- Economic slowdown caused by increasing interest rates and sustained restrictive policy from the Federal Reserve

The Platts TSI Daily Midwest HRC Index was down $20 to $800.

The CME Midwest HRC futures curve is below, with last Friday’s settlements in white. The entire curve shifted lower last week, with Nov.22-May.23 futures settling at its lowest levels in the last month.

Steel Hedging | Steel Futures | Steel Price Risk Management

Steel Trading | Voluntary Carbon Credits

The July durable goods report showed a significant shock to the supply and demand battle with more shipments than new orders for the first time since November 2021. While new orders have risen from this time last year, the trend has slowed compared to recent months.

Upside Risks:

- China reopening its economy with further stimulus measures

- Unplanned & extended planned outages, including operational issues leaving mills behind

- Energy issues abroad curtailing global production

- Easing supply chain restraints and labor shortages causing an increase in manufacturing activity

- Reluctance in placing import orders, leading to a dramatic reduction in arrivals later this year

Downside Risks:

- Decreasing input costs allowing mills to aggressively sell lower while remaining profitable

- Increased domestic production capacity leading to an increase in competitive pricing

- Steel consumers substitute to lower-cost alternatives

- Limited desire to restock at elevated prices and persistently short lead times causing a “Buyer’s Strike”

- Economic slowdown caused by increasing interest rates

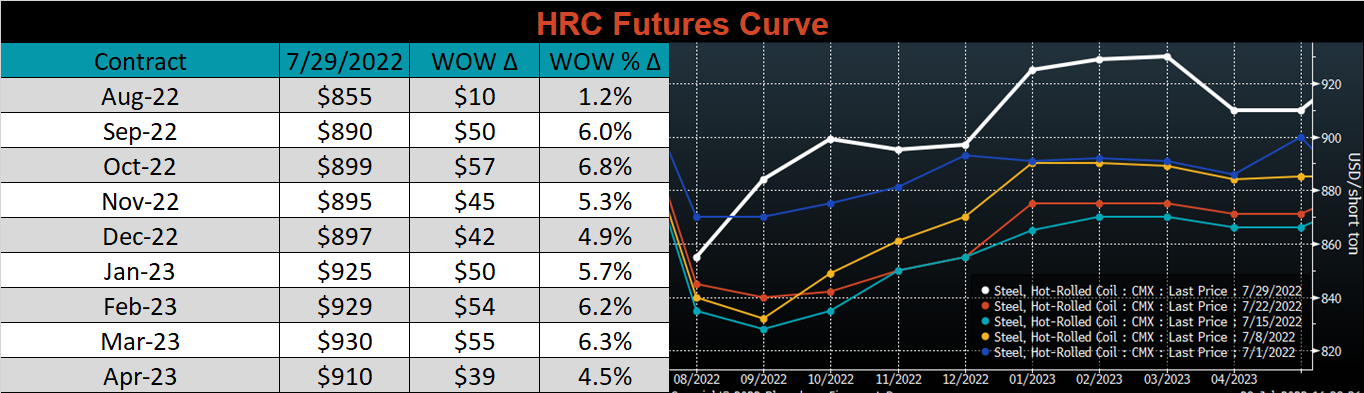

- The Platts TSI Daily Midwest HRC Index was up $20 to $820.

- The CME Midwest HRC futures curve is below, with last Friday’s settlements in white. The majority of curve shifted higher, most significantly in the front, which led to an overall flattening of the curve.

Steel Hedging | Steel Futures | Steel Price Risk Management

Steel Trading | Voluntary Carbon Credits

August inflation, labor market, and manufacturing data suggest further hawkish monetary policy will follow from the FED at the September meeting. Construction spending has grown YoY, but the data presents a negative outlook for the future in an increasing interest rate environment.

- The Platts TSI Daily Midwest HRC Index was up $40 to $800.

- The CME Midwest HRC futures curve is below, with last Friday’s settlements in white. The entire curve shifted $35-40 lower last week on the back of a worsening macro backdrop, declining input costs, and a stronger dollar.

Steel Hedging | Steel Futures | Steel Price Risk Management

Steel Trading | Voluntary Carbon Credits

Jerome Powell removed any doubt over the FED’s commitment to fighting persistent inflation in Jackson Hole, WY. The market expects further hawkish monetary policy until inflation returns to the FED’s target of 2%. Higher interest rates increase borrowing costs and lead to decreased capital investment. Existing suppliers will likely be faced with variable demand and price volatility for unhedged steel.

Upside Risks:

- China reopening its economy with further stimulus measures

- Unplanned & extended planned outages, including operational issues leaving mills behind

- Energy issues abroad curtailing global production

- Easing supply chain restraints and labor shortages causing an increase in manufacturing activity

- Reluctance in placing import orders, leading to a dramatic reduction in arrivals later this year

Downside Risks:

- Decreasing input costs allowing mills to aggressively sell lower while remaining profitable

- Increased domestic production capacity leading to an increase in competitive pricing

- Steel consumers substitute to lower-cost alternatives

- Limited desire to restock at elevated prices and persistently short lead times causing a “Buyer’s Strike”

- Economic slowdown caused by increasing interest rates

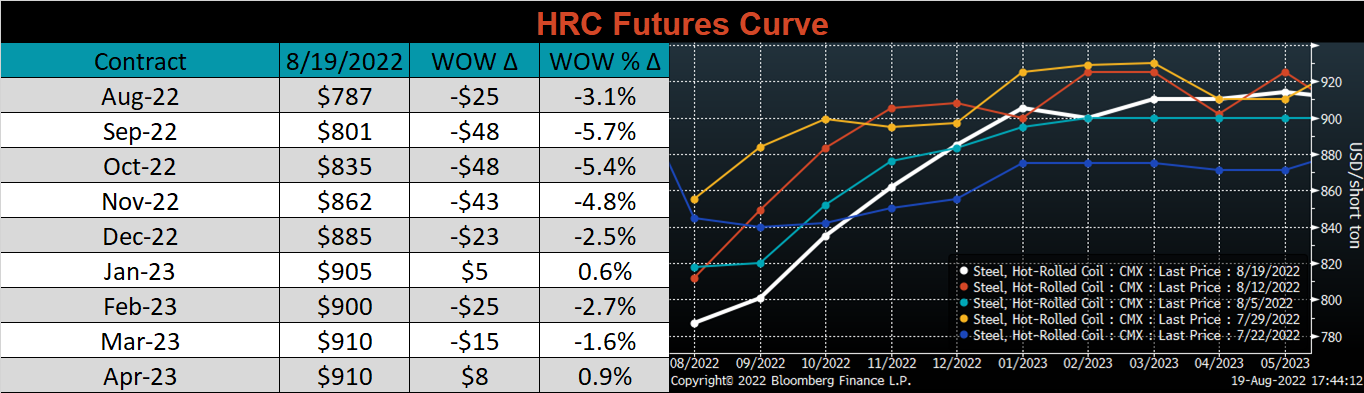

- The Platts TSI Daily Midwest HRC Index was down another $30 to $760.

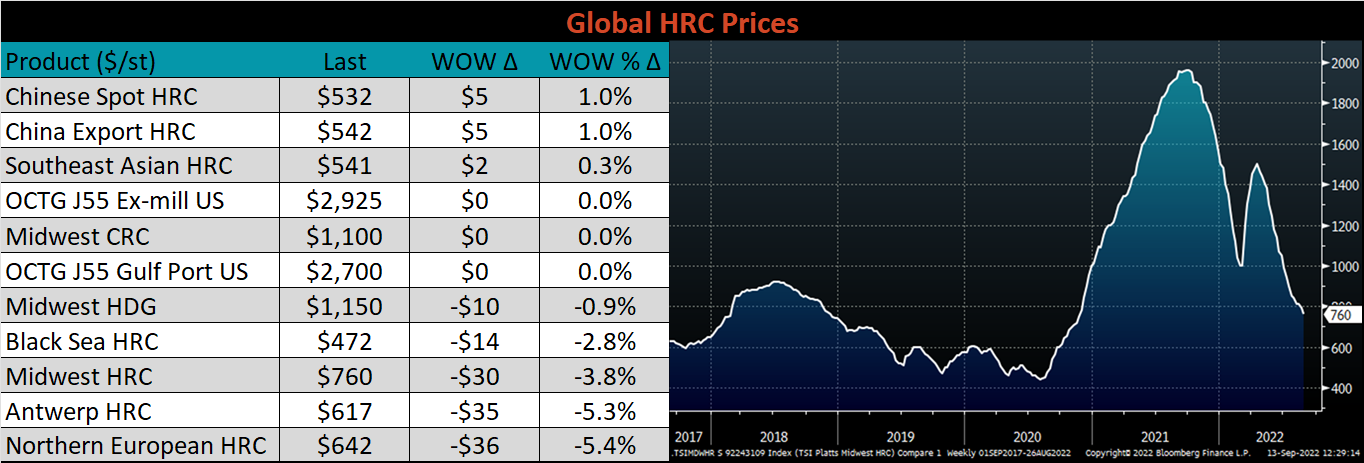

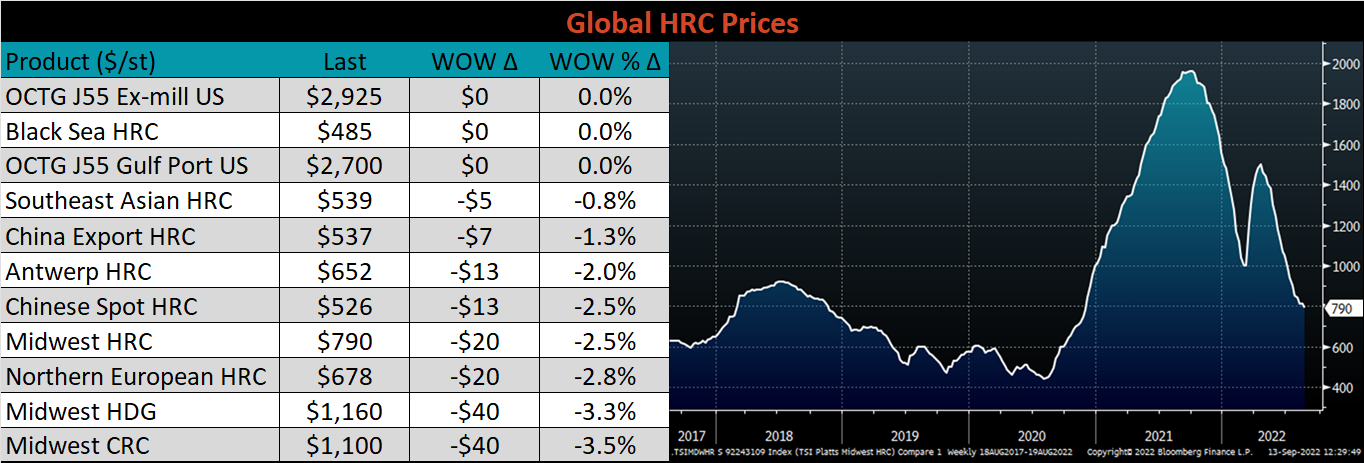

- Global prices were mostly lower everywhere, except for China. The Chinese spot and export prices were each up 1%

- The CME Midwest HRC futures curve is above last Friday’s settlements in orange. The back of the curve moved lower last week, while the front was essentially unchanged.

Steel Hedging | Steel Futures | Steel Price Risk Management

Steel Trading | Voluntary Carbon Credits

Input prices of busheling, pig iron, and shredded scrap have all fallen to levels not seen since early 2021, continuing a rapid fall since peaking near the end of Q1 2022. At the same time, domestic mills have seen their profitability fall below pre-invasion levels and have subsequently decreased production to help support prices near an $800 level.

Upside Risks:

- China reopening its economy with further stimulus measures

- Unplanned & extended planned outages, including operational issues leaving mills behind

- Energy issues abroad curtailing global production

- Easing supply chain restraints and labor shortages causing an increase in manufacturing activity

- Reluctance in placing import orders, leading to a dramatic reduction in arrivals later this year

Downside Risks:

- Decreasing input costs allowing mills to aggressively sell lower while remaining profitable

- Increased domestic production capacity leading to an increase in competitive pricing

- Steel consumers substitute to lower-cost alternatives

- Limited desire to restock at elevated prices and persistently short lead times causing a “Buyer’s Strike”

- Economic slowdown caused by increasing interest rates

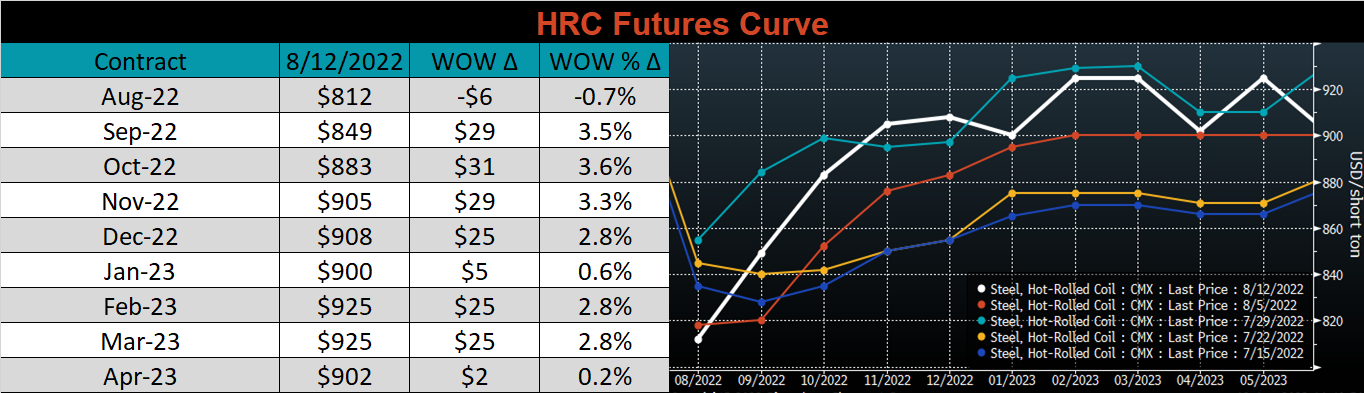

- After pausing last week, the Platts TSI Daily Midwest HRC Index continued its recent trend and was down $20 to $790.

- The CME Midwest HRC futures curve is above last Friday’s settlements in orange. The curve printed lower last week, with the front down the most significantly.

Steel Hedging | Steel Futures | Steel Price Risk Management

Steel Trading | Voluntary Carbon Credits

Our research shows that mills accounted for an increasing percentage of overall purchases relative to imports, a continuation of an eight-month trend. Domestic inventories fell while shipments rose as OEMs further destocking efforts coincide with an increasingly negative global economic outlook and the threat of increased interest rates.

Upside Risks:

- China reopening its economy with further stimulus measures

- Unplanned & extended planned outages, including operational issues leaving mills behind

- Energy issues abroad curtailing global production

- Easing supply chain restraints and labor shortages causing an increase in manufacturing activity

- Reluctance in placing import orders, leading to a dramatic reduction in arrivals later this year

Downside Risks:

- Decreasing input costs allowing mills to aggressively sell lower while remaining profitable

- Increased domestic production capacity leading to an increase in competitive pricing

- Steel consumers substitute to lower-cost alternatives

- Limited desire to restock at elevated prices and persistently short lead times causing a “Buyer’s Strike”

- Economic slowdown caused by increasing interest rates

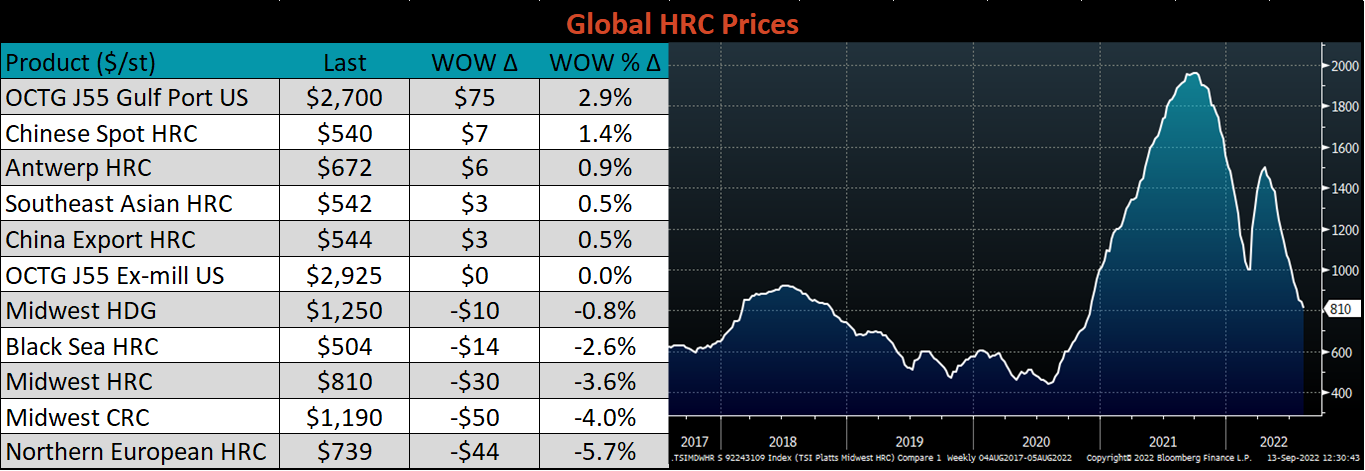

- The Midwest HRC Index was unchanged at $810. This is the first time in 16 weeks that steel prices held steady and did not fall.

- The CME Midwest HRC futures curve is above last Friday’s settlements in orange. The curve printed lower last week, with the front down the most significantly.

Steel Hedging | Steel Futures | Steel Price Risk Management

Steel Trading | Voluntary Carbon Credits

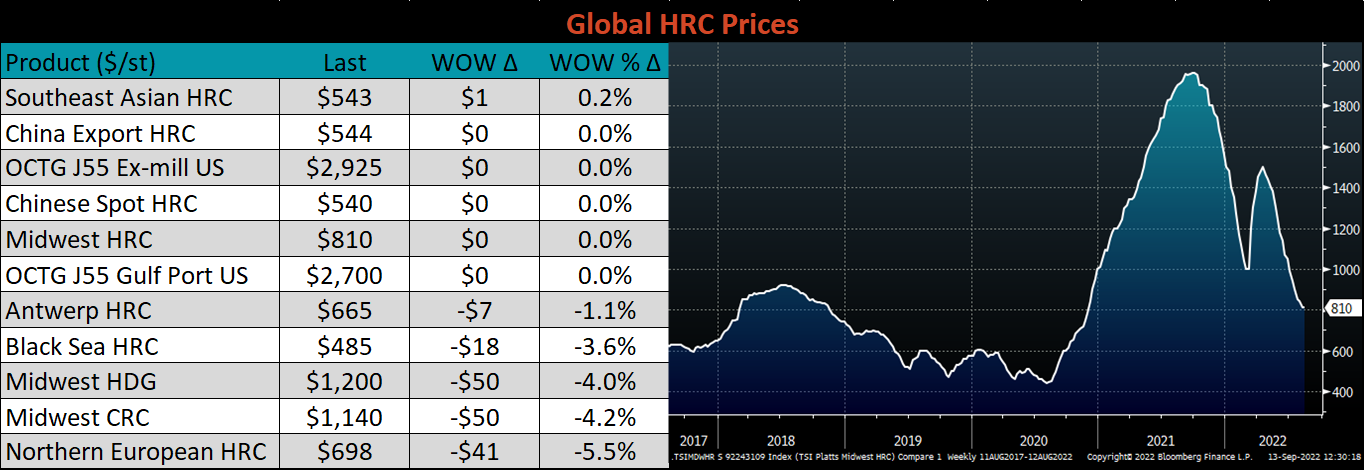

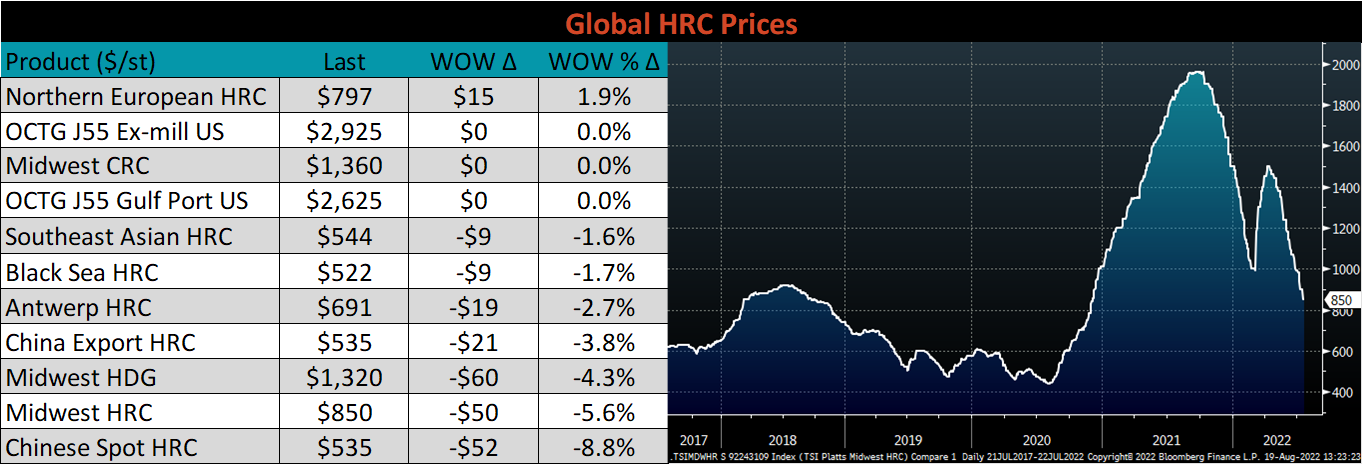

This month’s jobs report posted better than expected results as both the construction and manufacturing sectors posted strong numbers. The ISM Manufacturing PMI subindexes suggest demand is slowing while decreased strain on supply chains has opened the window for growth.

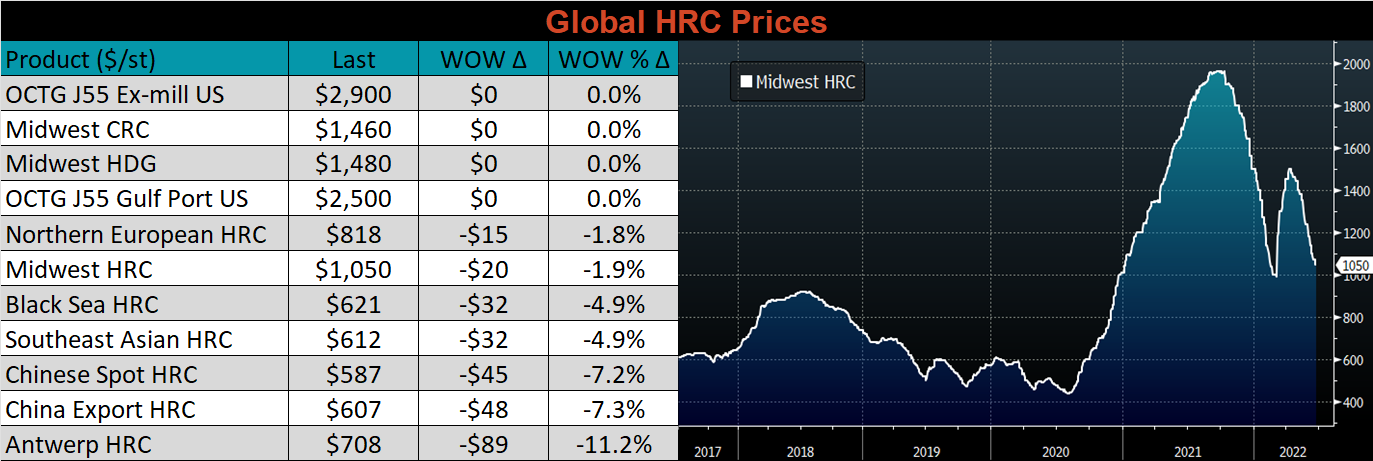

- Midwest HRC Index fell another $30 to $810.

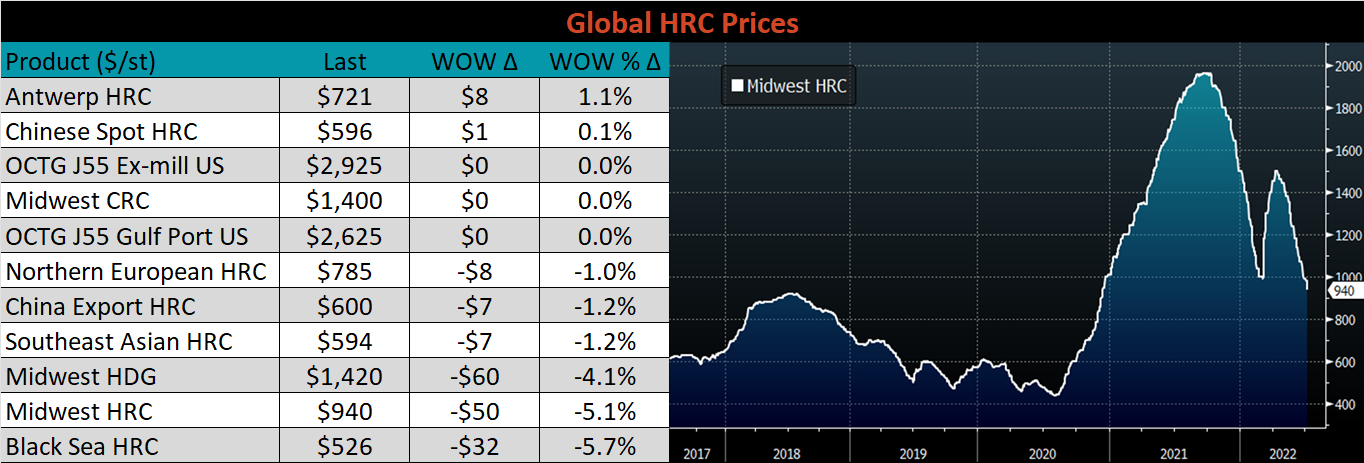

- Northern European fell 5.7%, while Chinese spot HRC was up 1.4%

- The CME Midwest HRC futures curve is above last Friday’s settlements in orange. The entire curve shifted lower last week, most significantly in the front with current levels pushing below the early-July trading range, causing to more significant contango.

Steel Hedging | Steel Futures | Steel Price Risk Management

Steel Trading | Voluntary Carbon Credits

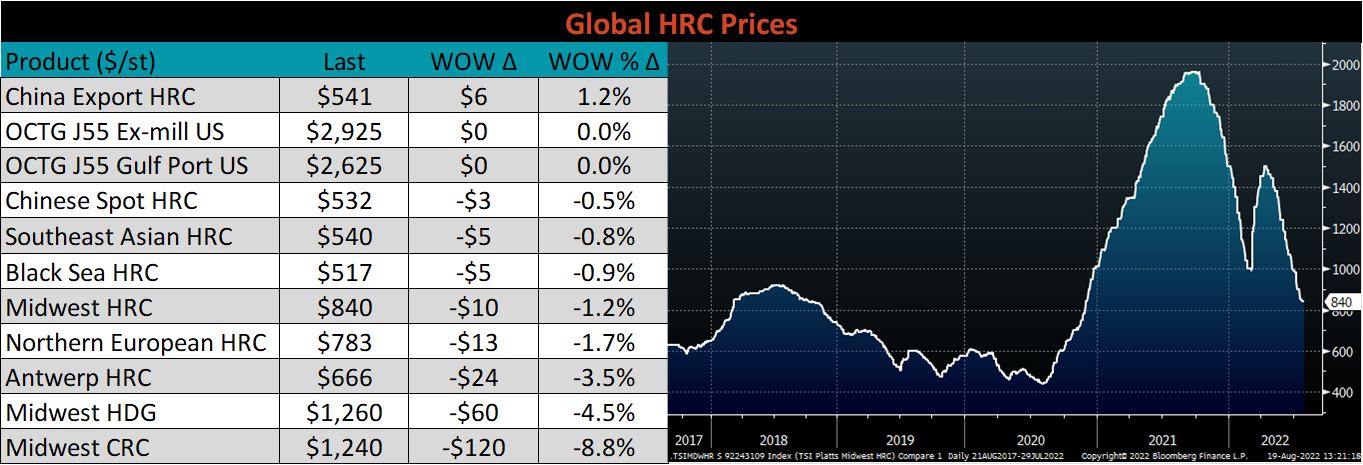

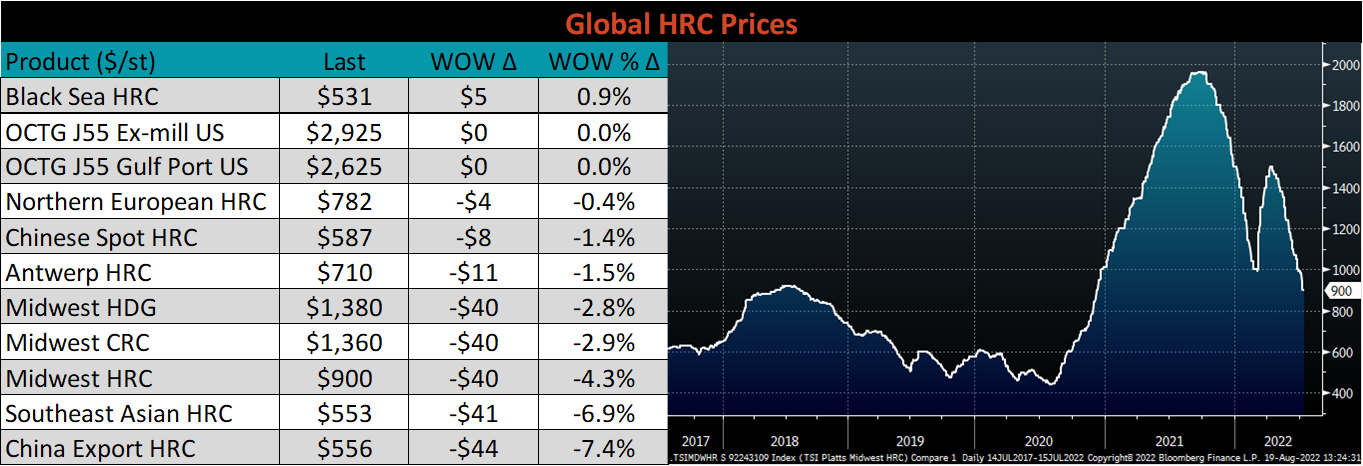

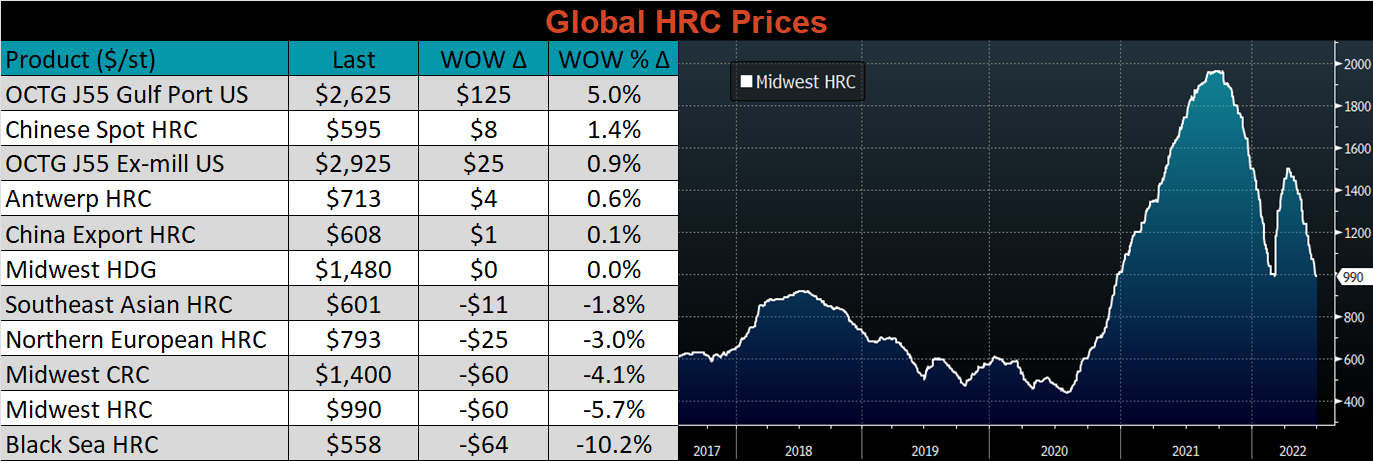

When global steel prices plus freight and applicable tariffs are at parity with domestic prices, it sets a floor for the U.S. domestic price by signaling that imports have been priced out of the market in the short-term. This spread has been converging rapidly since the beginning of May, with the U.S. price outpacing most global prices lower. Over the last two weeks, the first global differentials turned negative (Europe & Turkey), and today the remaining countries have approximately $70 remaining in their differential spread.

Upside Risks:

- China reopening its economy with further stimulus measures

- Unplanned & extended planned outages, including operational issues leaving mills behind

- Energy issues abroad curtailing global production

- Easing supply chain restraints and labor shortages causing an increase in manufacturing activity

- Reluctance in placing import orders, leading to a dramatic reduction in arrivals later this year

Downside Risks:

- Decreasing input costs allowing mills to aggressively sell lower while remaining profitable

- Increased domestic production capacity leading to an increase in competitive pricing

- Steel consumers substitute to lower-cost alternatives

- Limited desire to restock at elevated prices and persistently short lead times causing a “Buyer’s Strike”

- Economic slowdown caused by increasing interest rates

- The Midwest HRC Index was down another $10 to $840.

- Global flat rolled indexes were mixed on the week. Chinese export HRC, was up 1.2%, while Antwerp HRC was down 3.5%.

The CME Midwest HRC futures curve is above last Friday’s settlements in orange. The entire curve shifted higher last week with each price (ex. August) at it’s highest level in the last 5 weeks.

Steel Hedging | Steel Futures | Steel Price Risk Management

Steel Trading | Voluntary Carbon Credits

One of the major headwinds for the global steel market has been the sustained lockdowns and property slump in China. In response, the global production has started to throttle down and falling prices outside of China have started to lose their downward momentum.

Upside Risks:

- China reopening its economy with further stimulus measures

- Unplanned & extended planned outages, including operational issues leaving mills behind

- Energy issues abroad curtailing global production

- Easing supply chain restraints and labor shortages causing an increase in manufacturing activity

- Reluctance in placing import orders, leading to a dramatic reduction in arrivals later this year

Downside Risks:

- Decreasing input costs allowing mills to aggressively sell lower while remaining profitable

- Increased domestic production capacity leading to an increase in competitive pricing

- Steel consumers substitute to lower-cost alternatives

- Limited desire to restock at elevated prices and persistently short lead times causing a “Buyer’s Strike”

- Economic slowdown caused by increasing interest rates

- The Midwest HRC Index was down another $50 to $850.

- Global flat rolled indexes were mostly lower again as well, led by Chinese spot HRC, down 8.8%.

The CME Midwest HRC futures curve is above last Friday’s settlements in orange. Both the front and back end of the curve rose last week with middle months Nov-22 and Dec-22 remaining unchanged.

Steel Hedging | Steel Futures | Steel Price Risk Management

Steel Trading | Voluntary Carbon Credits

Import data shows a steady reduction in arrivals and that buyers are relying on the domestic mills more than they have at any point over the last year. If the ongoing trend of declining imports continues, domestic mills may find themselves in a strong negotiating position as OEMs destock. This would leave the US HRC price vulnerable to a significant rebound.

Upside Risks:

- China reopening its economy with further stimulus measures

- Unplanned & extended planned outages, including operational issues leaving mills behind

- Energy issues abroad curtailing global production

- Easing supply chain restraints and labor shortages causing an increase in manufacturing activity

- Reluctance in placing import orders, leading to a dramatic reduction in arrivals later this year

Downside Risks:

- Decreasing input costs allowing mills to aggressively sell lower while remaining profitable

- Increased domestic production capacity leading to an increase in competitive pricing

- Steel consumers substitute to lower-cost alternatives

- Limited desire to restock at elevated prices and persistently short lead times causing a “Buyer’s Strike”