Flack Capital Markets (FCM) offers two types of DBSTs, a short-form or Entry product and a long-form or Pro product. Both allow metals buyers to convert a fixed-price arrangement into a floating-price arrangement and vice versa. And neither requires buyers to undertake hedge accounting, keeping the process as seamless as creating a PO.

DIRECTED BUY STRUCTURED TRANSACTIONS (DBST)

ACCESS HEDGING & PRICE RISK MITIGATION— NO PHYSICAL SUPPLY REQUIRED

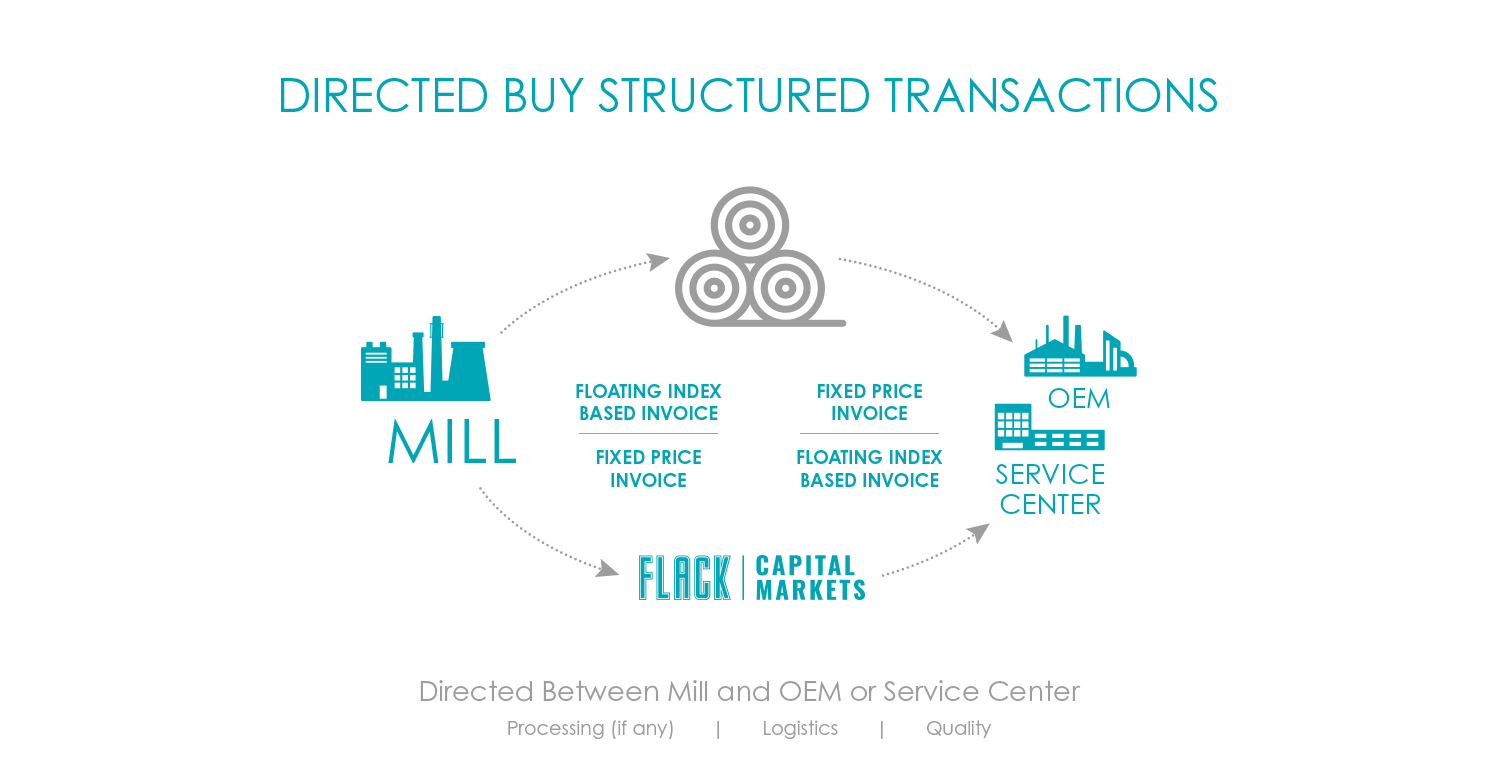

Directed Buy Structured Transactions (DBSTs) function as structured swaps, allowing you to convert floating contracts to fixed, or fixed to floating.

Directed Buy Structured Transactions (DBSTs)

OEMs can access forward curve pricing for flat-rolled products—without disrupting existing supply relationships—whether they:

- Buy direct from the mill

- Purchase through a service center

- Assign directed buys to a service center

Service centers looking to avoid the operational and administrative burden of hedging can also rely on DBSTs.

-

SHORT-FORM OR ENTRY

Best for buyers who are comfortable with simple hedging strategy, who don’t want to worry about margin calls, and who only want to convert pricing once.

-

LONG-FORM OR PRO

Best for buyers who are comfortable with advanced hedging concepts, who have ability to forward margin call payments if required, and who want the ability to modify positions during the agreement.