Fundamental Report

Supply-Side Takeaway:

The sharp drop in prices, alongside increasing production and imports clearly signal that the market is operating in a surplus. Furthermore, the existing announced outages do not appear to be significant enough to offset our 3-month forecast for imports.

The spread between Domestic – Global spot prices contracted further, primarily due to domestic price falling more sharply than those globally. For imports, January saw the highest level of arrivals since August 2022, aligning with our expectations. However, preliminary data for February suggests a modest drop in imports, likely reflecting the supply chain distributions and shipping delays. At the same time, US domestic production reached its highest point in five months, continuing its notable upward trend.

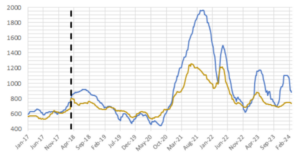

HRC Spot Prices – US Domestic & Global

- The global HRC spot price fell to $736 from $743, primarily due to a $17 decrease from Turkey, as well as a $9 decline from China, -$7 from Europe, and -$6 from Korea.

- The Domestic – Global HRC spread narrowed further, falling by $13.50 to $143.68. This marks a $232 total decline since peaking at $376 eleven-weeks ago.

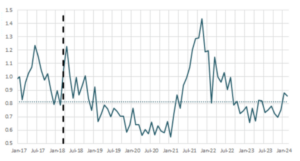

Total Sheet Imports (s.ton)

- Imports estimated sheet arrivals for February point to a slight reduction, falling to 858k from January’s final license data of 882k arrivals, which is the highest level of imports reached since August 2022. This week’s data aligns more closely with the expectations of imports trending higher.

- Supply chain issues and shipping delays could be potentially impacting the decline seen in the February imports estimate. However, January’s census data aligns with out anticipated level of imports.

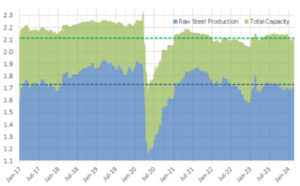

Domestic Production (s.ton)

- For the week ending on February 24th, capacity utilization ticked-up by 0.3% to 77.8%, and domestic raw steel production climbed to 1.727m from 1.721m net This is the highest level since September 2023.

- This brings the year-to-date production to 13.384m net tons, operating at a capacity utilization rate of 76.7%. This marks a -2.1% decrease from the same timeframe in the previous year, when production was at 13.673m net tons with a capacity utilization rate of 78.1%.