Fundamental Report

Supply-Side Takeaway:

Elevated imports and domestic production continue to be the most important story for the U.S. steel market. Until the surplus is worked through, it is hard to see a strong bullish case for prices.

The Domestic – Global HRC price differential contracted further, mainly due to the domestic spot price declining more than the global average edged higher, reaching its lowest point since October 2023. For imports, the preliminary data for May arrivals continue to indicate a trend higher, pointing to a level just above 1M st./m. The estimate came in slightly lower than last week’s but still was a notable increase from April’s final census data. Meanwhile, domestic production maintained its upward trend, ramping up to a level not seen since early April.

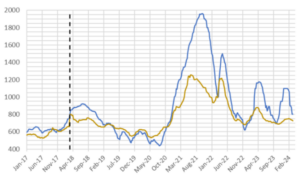

HRC Spot Prices – US Domestic & Global

- The global HRC spot price rose by $2 to $697. This week main price movements were from Turkey, which dropped by $11, from China increasing by $14, and from Korea rising by $11.

- The Domestic – Global HRC spread continued to contract this week, narrowing from $65 to $53, reaching a level not seen since October 2023.

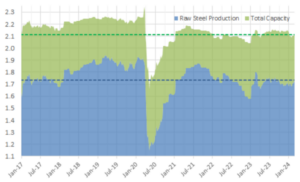

Total Sheet Imports (s.ton)

- This week’s imports estimated sheet arrivals for May continue to indicate a trend higher for imports, climbing to 1.046M tons from April’s final census data figure of 987k, both pointing to levels not seen since 2022.

- Potentially seeing the impact/roll over from the shipping delays caused by the supply chain disruptions.

Domestic Production (s.ton)

- For the week ending on May 25th, capacity utilization ticked up by 0.3% to 78.1% and domestic raw steel production climbed to 1.735m from 1.728m/tpw.

- This brings the year-to-date production to 35.437m, operating at a rate of 5%, -2.7% below this point last year.