Fundamental Report

Supply-Side Takeaway:

Upward pricing momentum in the U.S. is losing steam while previously stagnant levels of supply are the early stages of trending higher.

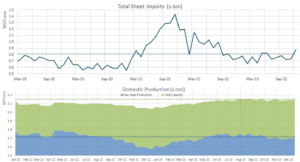

While the domestic spot price remained static, the global price kept steadily making gains despite China’s price continuing to slow down, resulting in a slight contraction in the Domestic – Global differential. Imports, after remaining subdued for majority of the year, have realized a noticeable uptick to end 2023. Similarly, US domestic production experienced a significant uptick last week after remaining surprisingly low given the rapid pace of the recent rally. Going into next year we anticipate the trend of increasing supply to continue through 1Q24.

Notes:

- The global HRC spot price rose to $739, with Russia, Brazil, and Europe being the main drivers behind this most recent

- The Domestic – Global HRC spread fell to $360, mainly due to the domestic spot price remaining unchanged and the global price rising by $15.20.

- Despite this, the spread remains in the elevated levels seen during January 2022

- Imports estimated arrivals for December jumped to 878k, with estimated arrivals for November sitting at

- For the week ending on December 16th, capacity utilization ticked up by 8 to 74.6%, bringing domestic raw steel production up to 1.714m net tons.

- This is the highest level of utilization since the first week of October.