Macro Report

Week’s Takeaway:

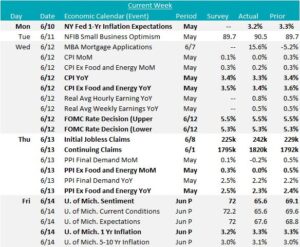

This was a big week for inflation and interest rates, while very little data was released on the industrial side.

Notes:

Both CPI (Consumers) & PPI (Producers) inflation data were released this week and provided encouraging signals after MoM readings remained stubbornly higher to start the year. May Topline CPI YoY came in at 3.3%, down from last months 3.4% and below an expected flat print. The disinflationary move was even more pronounced for Core CPI YoY, printing down to 3.4%, below the expected 3.5% and well under the 3.6% from April. May’s Core PPI YoY was also encouraging, printing down to 2.3%, down from last month’s 2.4% reading and in stark contrast to the median forecaster expectation of a resurgence to 2.5%.

There are two additional pieces of context needed with this months better than expected prints. First, forward looking consumer expectations continue to run hot – University of Michigan 1yr inflation came in above expectations, printing flat at 3.3%, while the NY FED 1yr inflation expectation printed at 3.2%, down from last months 3.3%. Both are only slightly below the current CPI, suggesting that consumers are expecting sticky price pressure. Second, FED officials continue to suggest that the current disinflationary trend is not enough, and they will need to see more before they are confident, that inflation is headed back to their target of 2%.

On that note, the FOMC Rate Decision also came out this week. As expected, they held rates steady at 5.25-5.5%, but what was slightly surprising was the hawkish push in the dots (their projection for where rates will go). Here the median forecast went from 3 to 1 cuts in 2024, and from 3 to 4 cuts in 2025. Essentially pushing back, the timeframe and removing 1 cut altogether over the next 18 months. Also of note, the long- term expected rate was inched higher from 2.6% to 2.75%.

Finally, the NFIB Small Business Optimism rose above expectations of a flat print at 89.7, up to 90.5, and at the highest level of the year. The report clearly highlights some of the headwinds that we have referenced in the industrial sector because of sustained level of restrictive interest rates, however, the trend is an encouraging sign.

Next Week’s Notes:

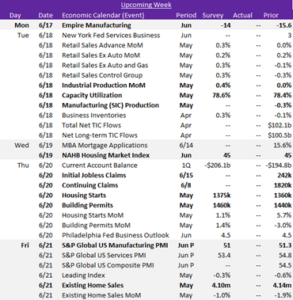

Next week, we will receive the first glimpses at manufacturing data for June with the release of the NY Empire Fed Manufacturing Survey and the preliminary S&P Global US Manufacturing PMI. The PMI is expected to dip to 51 from May’s 51. Additionally, May’s Manufacturing (SIC) Production and Industrial Production MoM figures will be available. Industrial Production is anticipated to rise by 0.4% from last month’s flat reading.

May’s Capacity Utilization is forecasted to tick up slightly to 78.6% from 78.4%. Overall, these expectations suggest a cautious optimism in the manufacturing sector, with a focus on modest growth rather than rapid expansion.

Key housing data will also be released in the upcoming week. The NAHB Housing Market Index for June is expected to remain unchanged at 45. For May, Housing Starts are projected to increased slightly to 1375k from 1360k, and similarly, Building Permits are anticipated to rise slightly to 1460k from 1440k. Finally on the housing data front, May’s Existing Home Sales will be issued, with forecasts of a decline to 4.10m from the prior month’s 4.14m.