Technical Report

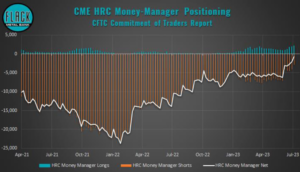

Flash Report: Hedge Funds Reduce Bearish Bets on US HRC to Lowest Level in 32 Months

Money managers have significantly decreased their bearish bets on COMEX US HRC contracts, reducing their net short positions by 1,410 contracts (equivalent to 28.2k short tons) to reach 716 contracts (14.3k short tons). This net-short position is the least bearish we have seen in nearly three years, primarily driven by a consistent reduction in short positions since January 2022. Additionally, money managers have displayed a modest bullish sentiment, increasing their long-only positions to the highest level since October 2020.

Money managers’ open interest, as a proportion of the overall US HRC futures market, has declined to 1.5% from a peak of 27% in February 2022. Despite this decrease in participation by money managers, the total open interest has remained steady between 20-30k contracts (equivalent to 400-600k short tons), indicating that other market participants have either entered the market or increased their activity.

With money-manager positions now relatively neutral, speculators have ample flexibility to take positions in either direction.