Macro Report

Week’s Takeaway:

Inflation and labor market data from this week continue to signal that interest rate cuts are not on the near-term horizon. Manufacturing data provided a mixed view but suggests the recovery in the sector is underway.

Notes:

CPI YoY and CPI (ex food & energy) YoY both came in above expectations in February, 3.2% vs 3.1% and 3.8% vs 3.7%, respectively. In a similar manner, PPI final demand YoY and PPI (ex food & energy) YoY both came in above market expectations for February, 1.6% vs 1.2% and 2.0% vs 1.9%. These figures, although not a significant increase, signal that the fight against rising prices in not over and the Fed will need more evidence of disinflation initiating rate cuts.

The March FED Empire manufacturing survey printed -20.9, well below expectations of -7. Taking a step back increasingly volatile over the last two years, making it increasingly difficult to glean true insight from the topline data.

Industrial & manufacturing production both came in above expectations in February, 0.1% vs 0.0%, and 0.8% vs 0.3%, respectively. This is additional support for the thesis that the manufacturing sector is on a path to recovery after a prolonged contraction.

Initial & continuing jobless claims continue to show a stable labor market, with major revision down in continuing claims.

The preliminary March University of Michigan consumer sentiment survey came in slightly below expectations, driven most significantly by increased concern for the future. 1 year inflation expectations were flat at 3.0% (versus the median forecast of 3.1%), and longer-term inflation expectations were unchanged. Earlier in the week, the February NY FED 1yr inflation expectations showed a similar story, coning in at 3.04% versus 3% in January. Although consumer expectations for inflation are historically poor at forecasting actual levels, these sticky datapoints continue to show that consumers believe the last leg of getting prices down to the FED’s 2% target will be difficult.

Next Week’s Notes:

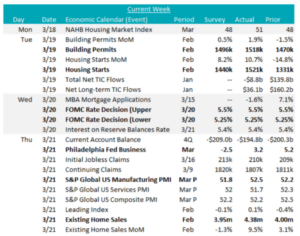

Next week’s data will provide insights into the housing and manufacturing sectors, as well as where the Federal Reserve stands on interest rate cuts.

For the housing sector, we are set to receive some February figures. building permits and housing starts are both expected to increase, with permits predicted to climb from 1470k to 1500k, and Housing Starts projected to jump from 1331k to 1430k. On the other hand, existing home sales are anticipated to decline, falling from 4.0m to 3.92m. These market expectations signal further activity in the housing sector.

In manufacturing, we will receive more March data. The Philadelphia Fed manufacturing survey is projected for a fall to 0 from 5.2, indicating a pause in growth momentum. Alongside, the preliminary S&P Global US Manufacturing PMI for March is expected to decline to 51.8 from 52.2, suggesting a slight softening in manufacturing activity. These market expectations signal a gentle slowing down as the sector navigates its recovery.

Finally, the FOMC will hold its second 2024 rate setting meeting, with market expectations that are almost certain that they will hold steady its benchmark interest rate once again at an upper bound of 5.5% and a lower bound of 5.25%. Current market expectations are for the first cut to be in June of this year, followed by 2 additional cuts before December. Our current view is that the underlying data will not provide enough support for a cut until July at the earliest.