Fundamental Report

Supply-Side Takeaway:

With significantly diminished appetite for imports after the impending trade action against coated products from the 10 named countries, the start of outage season, and the looming threat of indefinite idling for multiple blast furnaces, the risk to the upside is significant. On the other hand, soft demand and elevated inventories downstream will need to be worked through in the very near-term.

This week’s data: The Domestic – Global HRC price differential notably expanded further as the domestic spot price continues bubbling up while the global average price dropped. On the imports side, August arrivals preliminary estimate continues to indicate a decline from July’s rebound, with this week’s data showing a slighter fall. Domestic production ticked back up, maintaining to be on the higher end of the recent range.

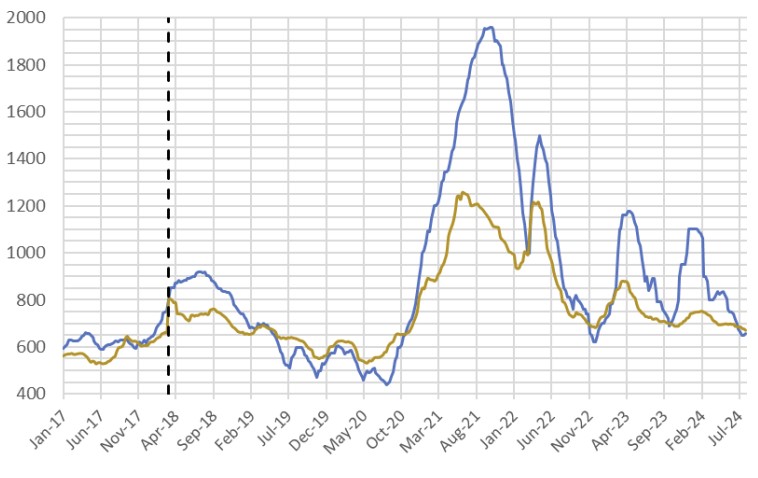

HRC Spot Prices – US Domestic & Global

HRC Spot Prices – US Domestic & Global

- The global HRC spot price dropped to $642 to $652. This decline was mainly due to China falling by -$26, Korea down by -$19, and Europe declining by -$13.

- The Domestic – Global HRC spread expanded further, widening from $37.94 to $57.60

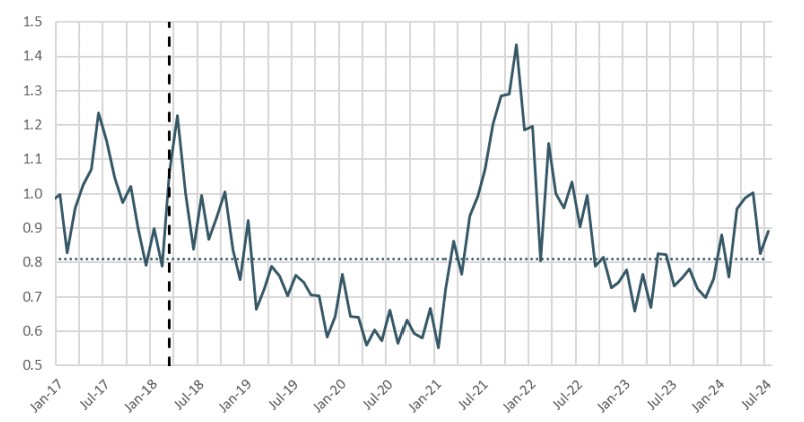

Total Sheet Imports (s.ton)

Total Sheet Imports (s.ton)

- This week’s imports estimated sheet arrivals for August indicate a decline from July’s rebounding, falling to 906k tons from July’s census data figure of 931k.

- Given the current negative differential, it is highly unlikely that we would see another surge in arrivals for the remainder of the year. That said, we do anticipate some volatility in these figures as we push below the longer run “neutral level”.

- The named countries from the filed trade petition represent nearly 80% of the expected total arrivals for coated products in 2024.

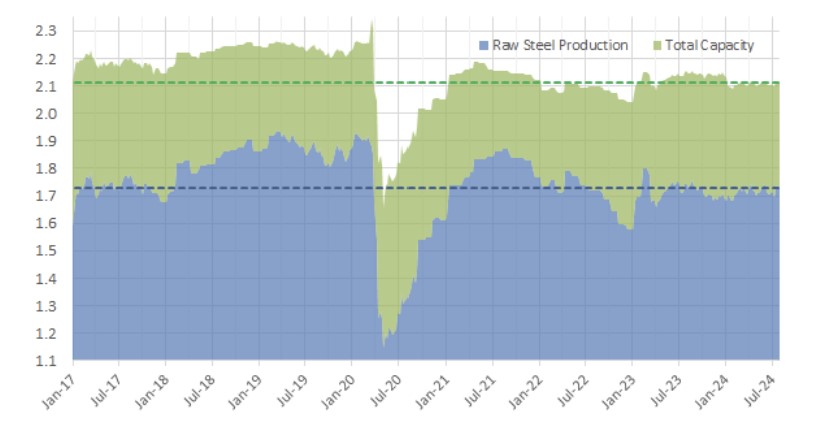

Domestic Production (s.ton)

Domestic Production (s.ton)

- For the week ending on September 7th, capacity utilization ticked up by 6% to 79.8% and domestic raw steel production rose to 1.772m from 1.760m/tpw.

- This brings the year-to-date production to 61.110m, operating at a rate of 7%, -1.8% below this point last year.