Fundamental Report

Takeaway:

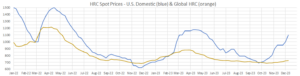

Spot steel pricing has closed its gap with the futures and price momentum is slowing as the recent surplus moves more into balance.

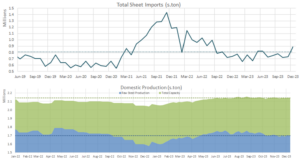

The Domestic – Global differential has widened further, driven by US prices regaining momentum after their three-week stall at $950. Global prices continue to gradually make gains since converging with the US price, despite China’s slip. Imports, after remaining subdued for the majority of the year, experienced a noticeable uptick, suggesting a higher risk for increased arrivals as we enter 2024. Meanwhile, US domestic production continues to hover at relatively low levels according to the AISI data, contributing to ongoing supply restraints.

Notes:

- The global HRC spot price reached $724, with Turkey and Europe being the main drivers behind this most recent increase. Meanwhile, China’s price fell slightly – it’s first decline in 7 weeks.

- The Domestic – Global HRC spread rose to $376, surpassing the spreads seen in the spring of 2023 and approaching levels last seen in the January 2022 peak.

- The preliminary December imports estimated arrivals jumped to 887k, with November sitting at 737k.

- For the week ending on December 9th, capacity utilization ticked down by 3 to 73.8 percent, bringing domestic raw steel production down to 1.697m net tons.