Macro Flash Report

NFIB Small Business Optimism

Takeaway:

Prior to the outcome of the election, small business optimism was continuing its upward trend, while uncertainty reached an all-time high. This index will provide insight into the direction of capital investment and manufacturing activity before the hard data, and thus will be significant going into the new year.

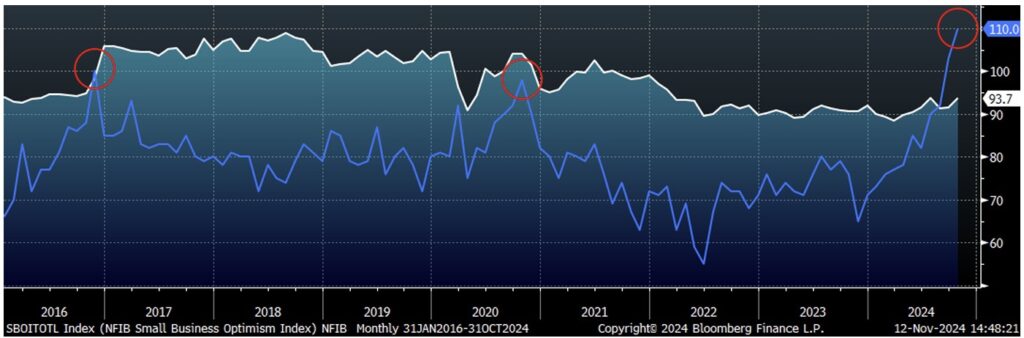

NFIB Small Business Optimism & Uncertainty Index

In October, the NFIB Small Business Optimism rose to 93.7 from 91.5 in September, surpassing market expectations of a slight increase to 91.9 and reaching the highest level in three months. However, the index furthered its streak below the 50-year average of 98, marking the 34th month. The Uncertainty Index surged by 7 points to 110, hitting the highest reading recorded.

Commentary around the surveys results indicated that the Uncertainty Index should ease as the election is over. Small business owners are still facing challenges such as low sales, unfilled jobs openings, and ongoing inflationary pressures, however, remarks suggest that optimism is on the rise and owners remain hopeful as they enter the holiday season.

Other key findings include:

- Sales: A net negative 20% reported higher nominal sales in the past three months (down 3 points), the lowest since July 2020. The net percent of owners expecting higher real sales volumes rose to a net negative 4% (up 5 points), the highest reading of this year.

- Labor: 35% of small businesses were unable to fill open positions (up 1 point), and compensation trends waned, with 31% raising compensation (down 1 point), the lowest since April 2020.

- Inflation Concerns: 23% of owners cited inflation as their top business concern (higher input and labor costs), unchanged from September, remaining the top issue.

- Loan Costs: A net 5% reported paying higher rates on their most recent loan (down 7 points), the lowest since January 2022.