Macro Report

Week’s Takeaway:

This week’s data offer further support that manufacturing activity reached its local bottom and is on the road to recovery. Additional data along with Fed official’s comments, continue to push back the start of the rate cutting cycle.

Notes:

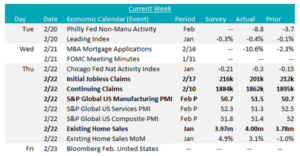

The preliminary S&P Global US Manufacturing PMI data showed an encouraging signal printing at 51.5, above expectations of 50.7. This is the strongest level of manufacturing expansion since September 2022 and the second consecutive print in expansion territory, a feat that has not occurred in 15 months. This is a promising signal, however, after the prolonged period of contraction, we are still months away from a full manufacturing recovery.

The overall level of January Existing Home Sales came in 4m units, this higher than expected on an overall basis, after December data was revised higher. The uneven recovery remains intact since October’s 13-year low level for sales.

Jobless claims continue to show that the labor market is stable. Initial claims came in at 201k, below expectations of a slight increase to 216k. This is the lowest level in 5 weeks. Continuing claims also came in below expectations, down to 1,862k versus the survey estimate of 1,884k. The 4-week averages are both trending slightly higher, but well below levels of concern.

Next Week’s Notes:

Next week’s data will provide insights into some of the main steel intensive sectors, as well as an update on inflation.

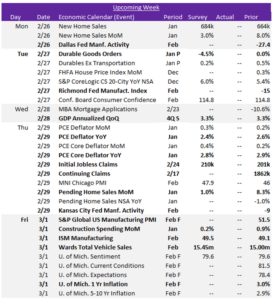

The upcoming week will have a significant release of manufacturing data, eagerly awaited as recent indicators suggest the sector may be emerging from its bottom and beginning to recover. One highlight will be the completion of February’s Fed Manufacturing Surveys. Despite the absence of market forecasts for these, optimistic results from the NY Empire and Philadelphia bolster anticipation that their counterparts in Dallas, Richmond, and Kansas City will also report positive outcomes. Another highlight is the final February figures for the S&P Global US Manufacturing PMI and the ISM Manufacturing Index. The latter is expected to rise to 49.5 from 49.1, reinforcing the indications of a recovery in manufacturing.

We’re also set to receive an update from the construction sector. The Construction Spending report for January anticipates a modest month-over- month growth of 0.2%, marking a slowdown from the previous month’s 0.9%.

Additionally, the auto sector is poised for an update, with February’s data from Wards Total Vehicle Sales projected to rise to 15.45m from 15m in January, signaling a rebound.

Lastly, we will get the final February data from University of Michigan’s inflation reports and January’s PCE data, with market expectations for the PCE Deflator YoY and the PCE Core Deflator YoY to both show slight easing, falling to 2.4% from 2.6% and 2.8% from 2.9%, respectively. One risk to keep on our radar going into Q2 is the loss of “goods sector” disinflation with the potential for a manufacturing recovery over the next 6 months.