Macro Report

Week’s Takeaway:

This week, manufacturing and housing data disappointed, while labor and inflation data came in better than expectations. The primary concern for the FED going forward is that the continued weakness in industrials results in negative spillover in the labor market.

Notes:

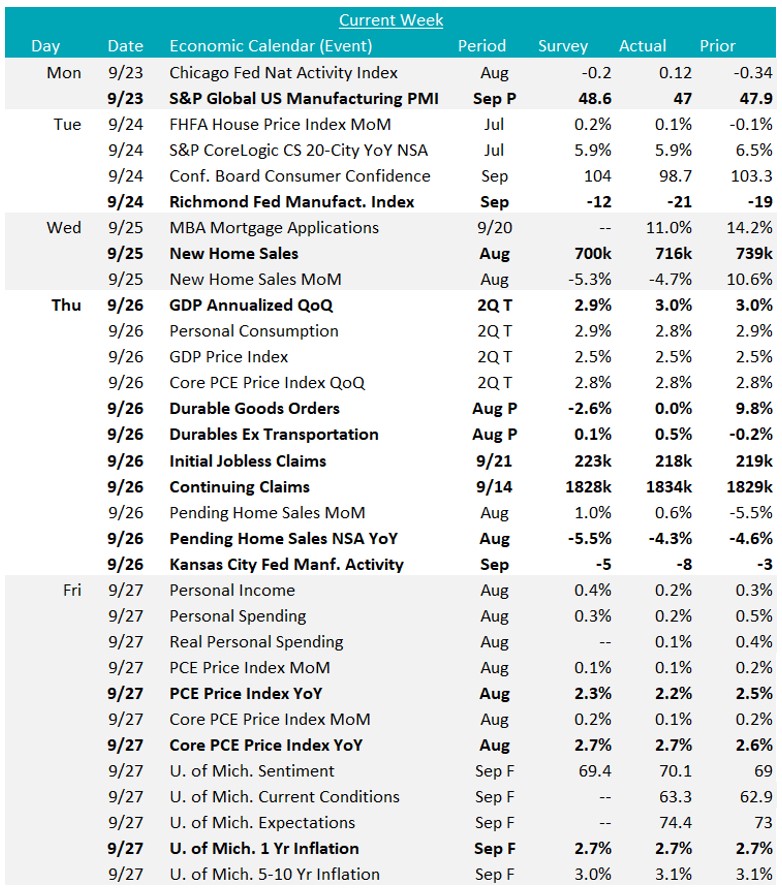

The preliminary September S&P Global Manufacturing PMI fell to 47, from 47.9 in August, and below the expectation of an increase to 48.5. This came along with worse than expected prints for this week’s Regional Fed Manufacturing Surveys. Richmond printed -21, down from -19 in August and below expectations of an improvement to -12. Kansas City also printed down to -8, from -3 last month and worse than the expected -5 print.

New home sales in August were down 4.7% compared to July but came in at 716k annualized homes sold, better than the expected 700k. Pending home sales rose 0.6% in August, below the expected 1% increase. Inventory data showed improvement, and initial data suggests that the recent decline in mortgage rates has led to a surge in refinancing, while mortgage applications saw another 11% weekly increase, up from last weeks impressive 14.2% surge.

The best news of the week came from the continued disinflationary trend seen in PCE (Personal Consumption Expenditures); the FEDs preferred measure of inflation. Here we see both the Topline and Core measure coming in below expectations, at (2.2% v 2.3%) and (2.7% v 2.7%), respectively. We anticipate both YoY measures to be sticky around current levels to end the year, due to 2H23’s significant disinflationary pressure, however, there is a real possibility that Core PCE could be back in the FEDs 2% target by the spring if the rapid cutting cycle does not lead to an overheated consumer. Encouragingly, the final September U. of Michigan Consumer Sentiment survey rose to 70.1, with consumer expectations of the 1yr inflation outlook sticky at 2.7% (the lowest level since December 2020).

Next Week’s Notes:

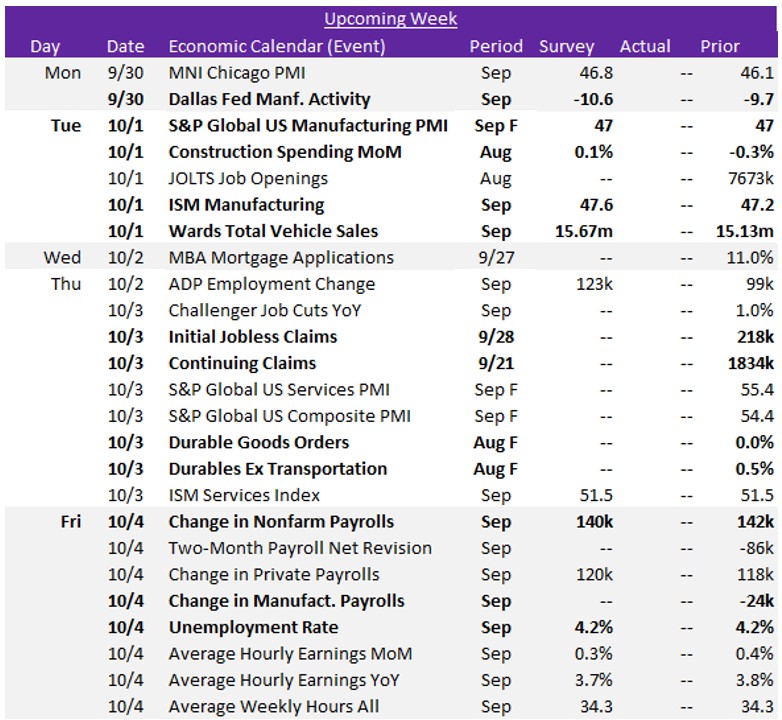

Next week, we will receive the final Regional Fed Manufacturing Surveys for September, the Dallas Index, which has market expectations of a fall to -10.6 from -9.7, concluding the September data releases. Following this, the series of first-of-the-month data will be published, covering the manufacturing, construction, and automotive sectors, along with the key jobs report.

In manufacturing, the final results for September’s S&P Global US Manufacturing PMI is forecasted to remain at the initial estimate of 47, and the ISM Manufacturing PMI is anticipated to tick up slightly to 47.6 from 47.2. These projections suggest that the sector remains under pressure. Additionally, the final results for August’s Durable Goods Orders report will be issued, which initial results surprised to the upside – a positive signal for underlying activity.

In the construction sector, August’s Construction Spending MoM is expected to increase by 0.1%, which would be a rebound from July’s disappointing -0.3% decline. For auto, September’s Wards Total Vehicle Sales is projected to rise to 15.67m from 15.13m. The market expectations of improvement for these figures may offer some support in terms of steel demand.

Regarding the labor market, the upcoming jobs reports will be crucial for assessing economic health and will influence expectations for the next Fed rate cut. Change in Nonfarm Payrolls is expected to decline slightly to 140k in September from 142k, suggesting moderating job growth, while the Unemployment Rate for September is anticipated to hold steady at 4.2%, indicating some labor market stability. The ADP Employment Change, a measure of private sector employment, is projected to rise to 123k from August’s 99k (the lowest reading since January 2021). Other important indicator to watch, for which forecasts are not yet available, include August’s JOLTS Job Openings, September’s Challenger Job Cuts, September’s Change in Manufacturing Payrolls, and the weekly update on Initial and Continuing Jobless Claims.