Fundamental Report

Supply-Side Takeaway:

This week, the U.S. Domestic – Global price differential shrunk to its tightest spread in 20 weeks, largely a result of the recent collapse in the U.S. price. In December, Chinese production hit its lowest level since February 2018. January’s update to the data showed a sharp rebound which has likely caused the recent global deterioration of prices.

HRC Spot Prices – US Domestic & Global

- The global HRC spot price fell to $733 from $736, primarily due to a $11 decrease from Turkey, as well as a $5 decline from Korea, and -$2 from China.

- The Domestic – Global HRC spread narrowed significantly, falling by $77 to $66.67. This marks a $309 total decline since peaking at $376 twelve-weeks ago.

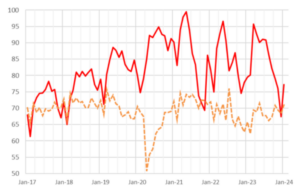

Global Production (millions) – China & ROW ex. China

- China’s production saw a substantial increase in January, up 14.5% to 77.2M tons, a recovery from its slump in December, where only 67.4M tons were produced.

- Elsewhere followed suit, rising 3.8% to 71M tons of production in January from 68.4M in December, with Europe and Asia China driving the tick higher while North American production was slightly down.

- This rise in production offers clarity on the global price deterioration which started at the end of January. Since then, Europe’s price has declined by $37, -$28 for Turkey, -$20 for China, and -$19 for Korea.