Fundamental Report

Supply-Side Takeaway:

The most interesting factor in the underlying data is the continued deterioration in global prices in the face of a stable US price. Supply available remains slightly elevated with March imports expected at their highest level in nearly 2 years.

This week, the U.S. Domestic – Global price differential expanded slightly, because of the stagnant US price, while the global average decreased marginally. For imports, preliminary data for February arrivals continues to suggest a slight reduction in imports, likely reflecting the supply chain disruptions and shipping delays impact. However, preliminary data for March’s arrivals are indicating a notable increase, suggesting an overall trend higher for imports. Meanwhile, US domestic production pulled back again, yet maintains above the 1.700m net tons level.

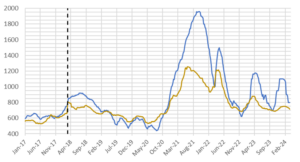

HRC Spot Prices – US Domestic & Global

- The global HRC spot price fell to $713 from $727, primarily due to a $27 decrease from China, as well as a $23 decline from Russia, -$18 from Europe, and -$15 from Korea.

- The Domestic – Global HRC spread widened, expanding by $14 to $87, continuing to remain at its lowest levels since October 2023.

Total Sheet Imports (s.ton)

- Imports estimated sheet arrivals for March point to a continued trend higher, rising to 1,069k from February’s estimated slight slump in arrivals of 840k. This week’s preliminary data for March, if realized, would reach the highest level of import arrivals since March 2022.

- Supply chain issues and shipping delays could be the reason for the February dip, but preliminary data is still showing an overall trend higher in imports.

Domestic Production (s.ton)

- For the week ending on March 16th, capacity utilization ticked down by 0.9% to 77.2% and domestic raw steel production fell to 1.714m from 1.734m/tpw, a notable

- This brings the year-to-date production to 18.307m, operating at a rate of 9%. This marks a -3.1% decrease from the same timeframe in the previous year, when production was at 18.886m with a capacity utilization rate of 77.7%.