Fundamental Report

Supply-Side Takeaway:

Domestic production and elevated import levels point to the market as being amply supplied. This is confirmed in the market by the fact that domestic pricing has lacked the momentum to achieve the last “announced price” of $900. The Domestic – Global HRC price differential contracted for the first time after expanding for several weeks, mainly due to the domestic spot price decreasing, while the global average continued to steadily decline. For imports, preliminary data for arrivals in March and April are indicating a continued trend higher for imports, both pointing to levels not seen in nearly two years. Meanwhile, domestic production slightly retreated after last weeks surge.

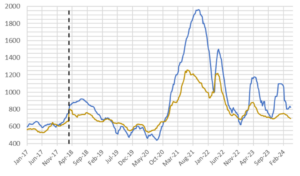

HRC Spot Prices – US Domestic & Global

- The global HRC spot price fell to $693 from $694, lengthening the downward This week the decrease was primarily due to Europe dropping by $16, while China was up $6, and Korea increased by $2.

- The Domestic – Global HRC spread contracted for the first time in seven weeks, narrowing by $9 to $132.

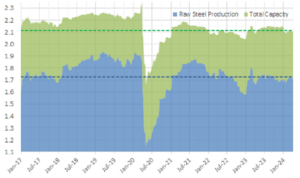

Total Sheet Imports (s.ton)

- Imports estimated sheet arrivals for April indicated a continued trend higher for imports, climbing to 1,033k from March preliminary figure of 990k, both pointing to levels not seen since June 2022.

- Potentially seeing the impact/roll over from the shipping delays caused by the supply chain disruptions.

Domestic Production (s.ton)

- For the week ending on April 13th, capacity utilization ticked down by 9% to 77.7% and domestic raw steel production fell to 1.726m from 1.745m/tpw.

- This brings the year-to-date production to 25.233m, operating at a rate of 4%, -2.4% below this point last year.