Macro Flash Report

Labor Market

Last week, non-farm payrolls came in well below expectations (175k vs, 240k) after months of higher-than-expected prints. This calmed the nerves of observers who were starting to think that the labor market and inflation were starting to reaccelerate and could soon warrant interest rate hikes. Looking more broadly, the labor market has been cooling slowly since early 2022 – going forward, this trend will need to continue for a soft-landing or no-landing scenario to materialize.

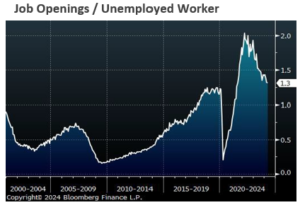

- In March, JOLTS Job Openings fell to 8,488k from 8756k, a decline that not only missed the forecasted 8,680k but also marked the lowest level since February 2021, with the construction sector experiencing the largest decrease.

- In April, Nonfarm Payrolls added 175k jobs, a deceleration from the 315k jobs added in March, and below the expected 240k. This slowdown suggests that the long-awaited cooling of the labor market could be That said, although this print is below the average monthly gain of 242k, it still is a healthy reading.

- Challenger Job Cuts YoY declined by -3.3% in April, with the auto sector facing the most cuts mainly due to Tesla but was a sharp drop from March’s 7% rise. Despite this decrease and the trend indicating a still tight labor market, there are expectations that companies may reduce hiring and further cuts in the coming months.

- The number of unemployment claims remained stable, with Initial Jobless Claims holding at 208k for the week ending April 27, underscoring the labor market’s resilience. This was lower than the anticipated 212k, and Continuing Claims were at their lowest since January at 1774k.

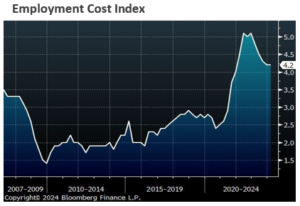

- In terms of wages and labor costs, the Average Hourly Earnings YoY in April increased by 3.9%, falling short of the expected 4.0% and marking the slowest growth rate since June 2021. The Employment Cost Index QoQ showed that compensation costs rose by 1.2% in Q1, an acceleration from the previous quarter’s 0.9% increase and surpassed the forecasted 0% growth, and employment costs rose the most in one year. Additionally, Nonfarm Unit Labor Costs QoQ increased by 4.7% in Q1 versus the forecasted rise to 4.0% from the prior reading of 0.4%.

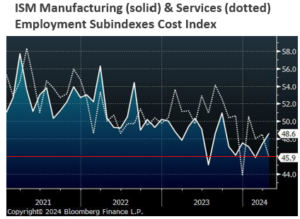

- In the manufacturing sector, Payrolls increased by 8k, surpassing expectations, although this followed a revised decrease of -4k jobs in March. Taking a step back, employment conditions in the broader manufacturing industry remain soft, as indicated by the stagnant or worsening readings in the FED Manufacturing Surveys and the ISM Manufacturing employment index, which continued to contract for the seventh consecutive month, albeit slower. Furthermore, the ISM Services PMI contracted for the first time since December 2022, driven largely by a sharper-than-expected decline in employment.